Balancing Opportunity and Loss: the Importance of Risk Management in Cryptocurrency Trading

Risk Management in Crypto Trading

Risk assessment allows investors to interpret and react to a changing market, make intelligent decisions and increase their chances for success in future investments.

When the market starts to become too risky, a risk management approach minimize the portfolio’s exposure to risks and reallocate investments to mitigate losses.

But risk is also opportunity, and when managing it, one should reach the right balance between opportunity and loss.

Risks management helps finding that balance. It involves measures and endeavors aimed at controlling and minimize any negative consequences by decreasing the probability, severity or impact of such risks.

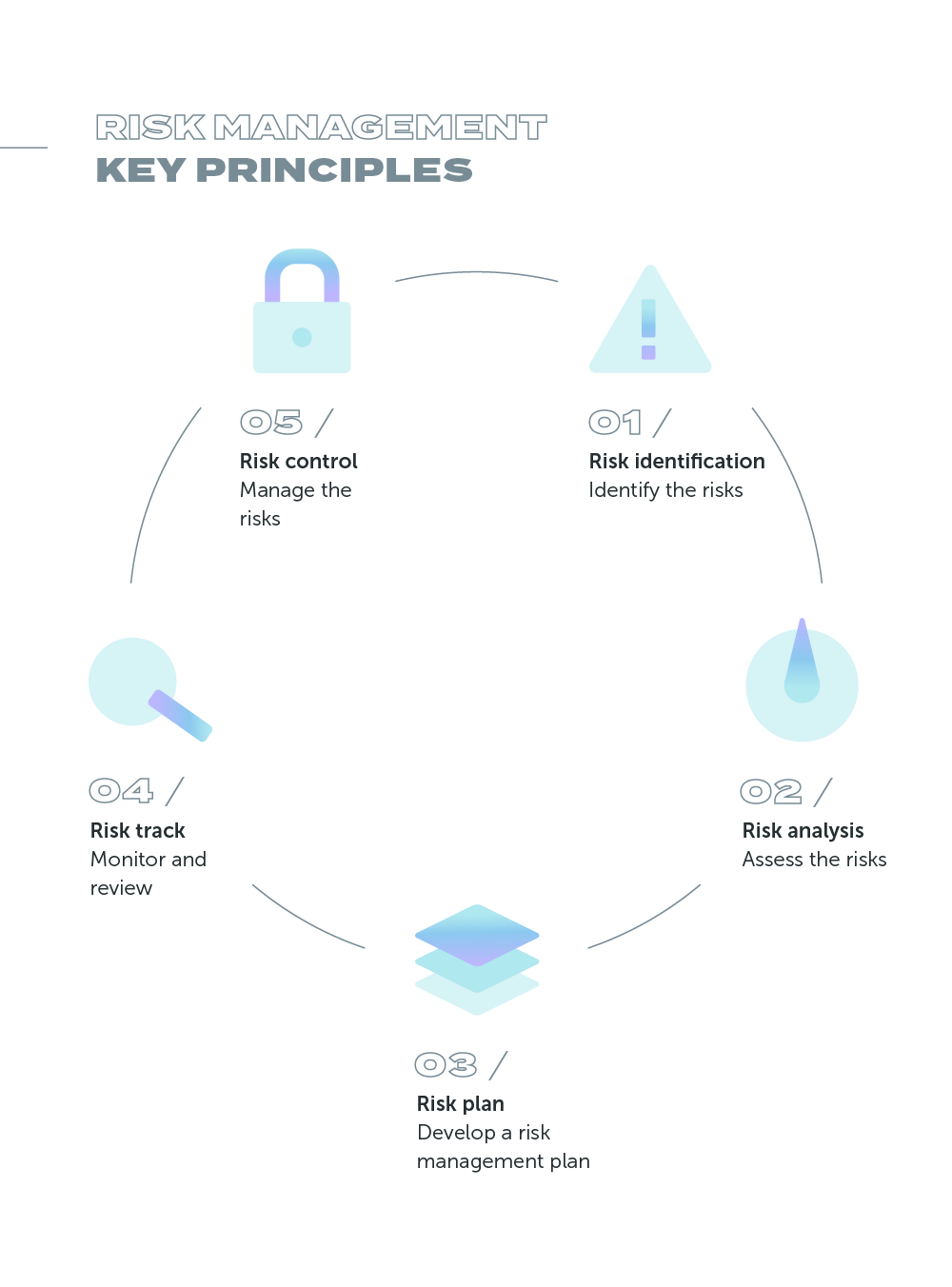

Typically, a risk management strategy follows these fundamental principles:

- Recognize all potential risks and their underlying causes;

- Analyze each risk to determine its likelihood, severity, and impact;

- Create plans for managing each recognized risk;

- Track progress towards implementing those plans;

- Periodically assess and modify the strategy as needed.

Overall, risk management is crucial in cryptocurrency trading, and traders who develop a sound risk management strategy are more likely to succeed in this volatile market.

Risk Drivers

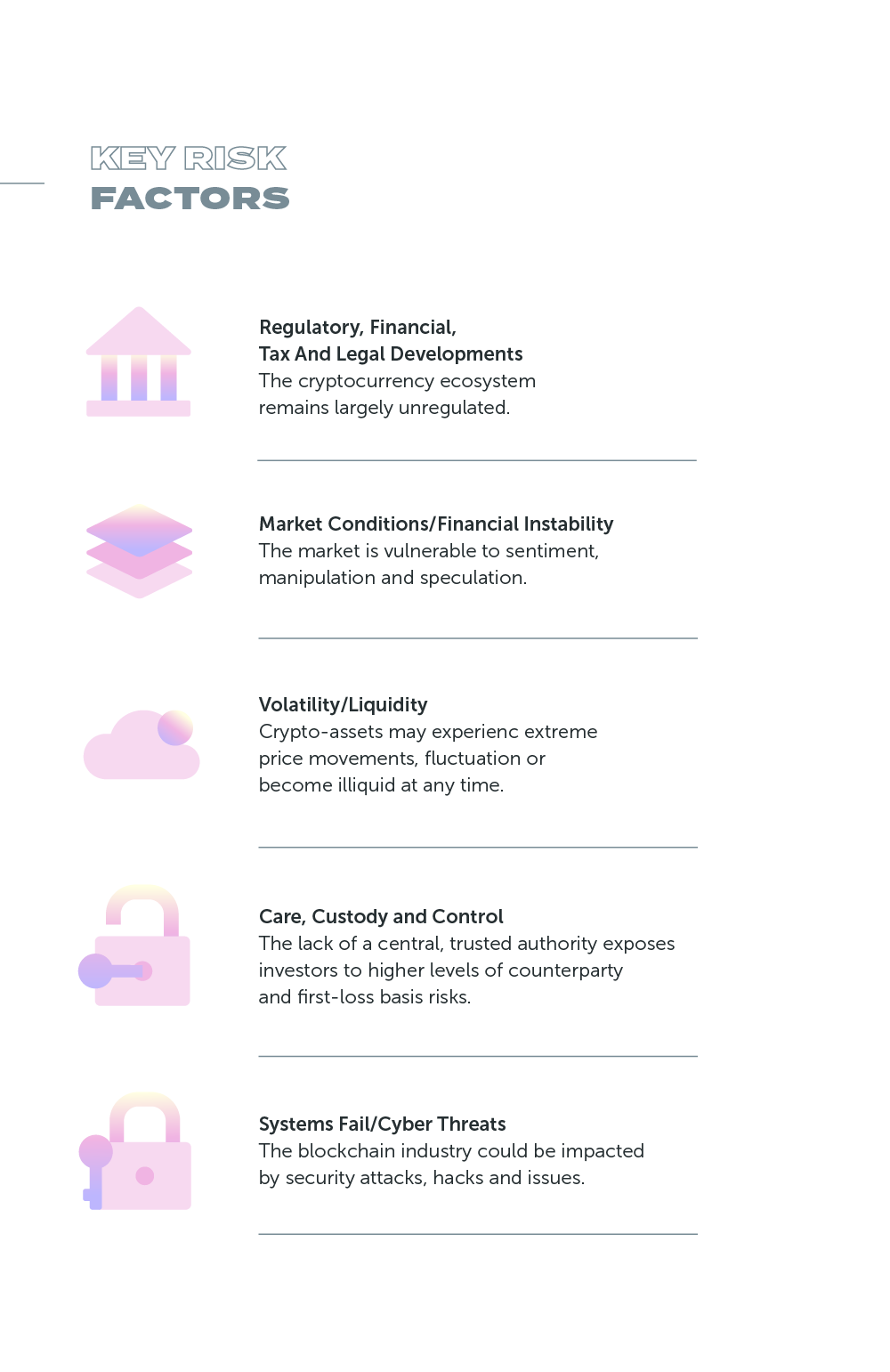

Cryptocurrency is considered a speculative and high-risk investment, and it is crucial to be aware of the potential dangers before engaging in any trading activities. The primary risk associated with trading cryptocurrencies is the high level of volatility, but there are several other risks associated with trading cryptocurrencies, including:

- Regulatory risks -> Despite its growing popularity and increasing attention, the cryptocurrency market remains largely unregulated, with different countries taking different approaches to its regulation. As a result, there are a number of challenges and risks involved for investors, including lack of investor protection and consumer protection or uncertainty around taxation and regulation enforcement. However, there are also ongoing efforts at the international level to regulate the crypto-asset ecosystem, with discussions taking place through organizations such as the G20, G7, Financial Stability Board (FSB), International Organization of Securities Commissions (IOSCO), Basel Committee on Banking Supervision (BCBS), Financial Action Task Force (FATF), and others. These efforts aim to address the various identified issues and promote greater harmonization in the market infrastructure.

- Security risks -> The absence of trusted third parties such as banks and governments in the cryptocurrency system creates a vector of insecurity as it relies solely on computer code. This introduces vulnerabilities in the system, making it unable to undo any harm if a protocol or software tool is found to have bugs.

- Liquidity risks -> Cryptocurrency markets can be thinly traded, which means that it can be difficult to buy or sell large amounts of digital assets without significantly affecting the price due to a lack of buyers or sellers, which can be caused by blockchain congestion or lack of standards for liquidity provision at centralized or decentralized exchanges. Investors need to consider the trade-off between illiquidity and market-making compression when managing their portfolios and make informed decisions based on market changes. They should also thoroughly research and perform due diligence on the liquidity and stability of their investments.

- Market manipulation/fluctuation risks -> The small size of the cryptocurrency markets makes them vulnerable to manipulation, particularly pump-and-dump schemes where large market players artificially inflate the price of a coin through coordinated buying, and then sell their holdings at a profit, leaving other investors with losses. This type of manipulation can have a significant impact on the price of a cryptocurrency and harm the overall reputation of the market. Additionally, market conditions – including changes in foreign exchange rates – can affect the demand for cryptocurrencies and impact their price, as well as investor sentiment and confidence can play a role in the volatility of the market. This can lead to changes in demand and supply, which can further contribute to price fluctuations.

- Technical risks -> While decentralization provides some inherent disaster and risk-proofing benefits compared to centralized databases, not all cryptocurrencies or tokens are the same in term of traceability, transaction ledgering and levels of trust or fiduciary responsibility. Investors should be aware of the technological risks – including the technological capability to handle demand or upgrades pending on pending technology adoption – and vulnerabilities that exist in some projects and understand that the complexity of the system may also pose potential risks as complex systems can fail in complex ways.

Risk Assessment

A crypto risk assessment involves a thorough analysis of the potential risks involved with investing in cryptocurrencies. This assessment considers various factors, such as weaknesses in the crypto and interfacing systems, as well as market entry and exit points that could be exploited by external actors to impact or manipulate cryptocurrency markets and system vulnerabilities.

There are a lot of approaches to determine risks, such as:

- a comprehensive technical analysis of each coin/token's performance, unique features, and long-term potential for growth, to make well-informed decisions. One approach to achieve this is by utilizing a cryptocurrency tracking application such as Delta or Blockfolio. These tools can assist in monitoring and analyzing the market and individual coins/tokens, aiding you in making informed decisions;

- a supply and demand balances analysis to better understand factors like exchange rate, market fluctuations, volatility and how an investment may pan out in the short, mid and long-term;

- the inner workings of crypto market to determine lows and highs and pinpoint potential risks that an average investor may not realize is happening in the market;

- a scenario analysis that helps predict possible future scenarios based on a probability of occurrence;

- a stress tests to examine what could happen within a specific timeframe if any new factors were introduced into the market.

A comprehensive crypto risk assessment should not only evaluate how the market will respond to an event but also anticipate any unexpected consequences that may arise when new technologies are introduced into society. It should also address relevant questions about regulation, examine the security properties associated with using various inputs for transactions, and assess susceptibility to attack vectors such as Sybil attacks or transaction malleability. In addition, a good crypto risk assessment should link together economic issues that are relevant to every type of investment decision, such as volume-weighted issues.

By conducting a thorough crypto risk assessment, investors can make more informed decisions about their investments and potentially mitigate the risks associated with investing in cryptocurrencies.

Risk Management Strategies

Below are some of the most useful risk management strategies in cryptocurrency trading:

Initial Risk Level

The initial risk level is the maximum amount of money that a trader is willing to lose on a trade. This level is determined based on the trader's risk tolerance, the size of their account, and the risk/reward ratio of the trade. Once the initial risk level is determined, the trader can set a stop loss order to limit their potential losses.

Profit Target

This indicates the price level at which a trader expects to take profits. This level is determined based on the trader's analysis of the market and the risk/reward ratio of the trade. The profit target is typically set at a level that provides a favorable risk/reward ratio.

Position Sizing

This is a risk management strategy that involves determining the amount of capital to risk on each trade. The position size is based on the risk of the trade and the size of the account. A trader with a larger account can afford to risk more on each trade than a trader with a smaller account.

Risk/Reward Ratio

It is used to determine the potential reward of an investment in comparison to its potential risk. The ratio is calculated by dividing the potential reward of a trade by the potential risk. For example, if a trader believes that the potential profit of a trade is $200, while the potential loss is $100, the risk/reward ratio would be 2:1.

In other words, the trader is willing to risk $1 to gain $2. A higher risk/reward ratio implies a lower risk and a higher potential reward, while a lower risk/reward ratio implies a higher risk and a lower potential reward. Traders use the risk/reward ratio to determine whether a trade is worth taking or not. A favorable risk/reward ratio can provide a better chance of making a profit while minimizing potential losses.

For example, if a trader has a $10,000 account and is willing to risk 2% of the account on a trade, the maximum amount they can risk is $200. The position size is then determined by dividing the maximum risk by the stop loss distance. If the stop loss is set at $20, the position size would be 10 contracts or shares.

Position sizing allows traders to manage their risk by limiting the amount of capital they put at risk on each trade. This strategy ensures that no single trade can significantly impact the trader's account, reducing the risk of losing everything in one trade.

Stop Loss and Take Profits

This strategy is used to limit potential losses and lock in profits, respectively. A stop loss is an order that is placed to sell a security when it reaches a certain price level. The purpose of a stop loss is to limit the amount of loss that a trader can incur in a trade. For instance, if a trader buys a stock at $50 and sets a stop loss at $45, the trader will automatically sell the stock if the price drops to $45, limiting the loss to $5 per share.

Take profit, on the other hand, is an order placed to sell a security when it reaches a certain price level. The purpose of a take profit order is to lock in profits. For instance, if a trader buys a stock at $50 and sets a take profit at $55, the trader will automatically sell the stock if the price reaches $55, locking in a profit of $5 per share.

Portfolio Diversification

Diversification involves investing in a variety of assets with different levels of risk and potential returns. The goal of diversification is to reduce the overall risk of a portfolio by spreading it across multiple assets, rather than relying on a single asset or investment, and potentially generate returns over the long term, even if some assets perform poorly.

For example, an investor might invest in a mix of cryptocurrencies that includes high-risk, high-potential assets like new ICOs or altcoins, as well as lower-risk, more established assets like Bitcoin or Ethereum. By diversifying their portfolio in this way, the investor can potentially benefit from the growth of high-potential assets while still having a safety net in the form of more established assets that are less likely to lose significant value.

Dollar-Cost Averaging

Dollar-Cost Averaging (DCA) is an investment strategy that involves investing a fixed amount of money into a particular asset at regular intervals over a period of time. With DCA, the investor purchases more units of the asset when the price is low, and fewer units when the price is high. The goal is to reduce the impact of volatility on the investment and potentially generate returns over the long term.

Let's say an investor wants to invest $1,000 in Bitcoin using DCA. They decide to invest $100 every week for ten weeks. If the price of Bitcoin is $10,000 in the first week, they will purchase 0.01 BTC with their $100 investment. If the price drops to $8,000 in the second week, they will purchase 0.0125 BTC. If the price rises to $12,000 in the third week, they will purchase 0.0083 BTC, and so on.Over the course of the ten weeks, the investor will have purchased a total of 0.0818 BTC at an average price of $9,770. Even if the price of Bitcoin drops significantly during this time, the investor's investment will still have some value, as they purchased at various price points.

The advantage of DCA is that it helps to reduce the impact of short-term price fluctuations on the investment. It allows investors to avoid making emotional decisions based on short-term price movements and instead focus on the long-term potential of the asset.

Hedge mode trading

Hedging is a risk management strategy that involves opening a position that is opposite to an existing position (but equal in size) in order to minimize potential losses. The goal of this strategy is to protect the investor's portfolio from adverse market conditions and potentially generate profits in both bullish and bearish market conditions.

Hedging typically involves opening both long and short positions on the same asset or on correlated assets. For example, an investor might buy Bitcoin while also shorting Ethereum, or viceversa. If the price of Bitcoin goes up while the price of Ethereum goes down, the investor can potentially profit from both positions.

Hedging can be a useful risk management strategy in volatile markets, as it helps to limit potential losses in the event of a market downturn or generate returns in a variety of market conditions. However, it can also be a complex and risky strategy, as it requires careful monitoring of market conditions and an understanding of the risks involved in shorting an asset.

Short Squeeze

This strategy involves taking advantage of a rapid increase in the price of an asset that is heavily shorted. When a large number of traders have shorted an asset, there is potential for a short squeeze to occur if the price of the asset starts to rise rapidly. This occurs when the traders who have shorted the asset are forced to buy it back at higher prices to cover their short positions, leading to a further increase in the price of the asset.

In cryptocurrency trading, a short squeeze can occur when a large number of traders have shorted a particular cryptocurrency, and there is sudden buying pressure that drives the price up rapidly. When this happens, the traders who have shorted the asset may be forced to buy back the cryptocurrency at higher prices to cover their positions, further increasing the price of the asset and potentially leading to a cycle of buying that can drive prices even higher.

To take advantage of a short squeeze, traders can buy the cryptocurrency in question in advance of a potential squeeze, with the hope of selling it for a profit when the squeeze occurs. However, short squeezes can be unpredictable and can lead to significant price volatility, making it a high-risk trading strategy that requires careful analysis and risk management.

Scaling out

This is a strategy in which investor gradually sells off a portion of their position as the price of the asset rises. This allows the trader to lock in profits while still maintaining exposure to potential upside.

For example, let's say a trader buys 100 shares of a stock at $50 per share. If the price of the stock rises to $60 per share, the trader may decide to scale out by selling 50 shares, locking in a profit of $1,000 ($10 per share x 50 shares). The trader would still hold 50 shares of the stock, allowing them to potentially profit from further price increases.

Scaling out can be an effective way to manage risk while maximizing profits, as it allows traders to lock in profits while still participating in potential upside. However, it requires careful analysis and risk management, as selling too many shares too quickly could limit potential profits, while holding on to too many shares could expose the trader to potential losses if the price of the asset declines.

Conclusion

Crypto trading carries a unique set of risks due to the volatility and complexity of the market. Here are some risk management rules to consider when trading cryptocurrencies:

- Do Your Research – Before investing in any cryptocurrency, conduct thorough research to understand the fundamentals of the project, its market potential, and the risks involved.

- Set Stop Losses – Establish stop-loss orders to limit potential losses in case of sudden price drops. This can help prevent emotional trading decisions that can lead to bigger losses.

- Use a Trading Plan – Develop a trading plan that includes entry and exit points, target prices, and risk management strategies. Stick to the plan and avoid making impulsive decisions.

- Diversify – Diversify your portfolio by investing in multiple cryptocurrencies, which can help spread risk and reduce potential losses.

- Consider Volatility – Take into account the volatility of the crypto market and adjust your risk management strategies accordingly. This may include increasing the use of stop-loss orders or reducing the amount of capital invested in riskier assets.

- Stay Informed – Keep up to date with the latest news and events that could impact the crypto market. This includes monitoring regulatory changes, technological developments, and market trends.

- Protect Your Assets – Keep your cryptocurrency assets secure by using secure storage solutions such as hardware wallets, and avoid leaving assets on exchanges for extended periods.

In the end, risk management is a crucial aspect of trading that involves implementing effective measures to minimize losses and avoid the total depletion of trading capital. By managing risks, traders can enhance their prospects of profiting from the market. In the absence of a robust risk management strategy, a few unfavorable trades could quickly wipe out a trader's significant profits.

References

- Olasunkanmi, A. (2021, July 26). Crypto trading strategies to reduce risk. Coinfomania. Retrieved from https://coinfomania.com/crypto-trading-strategies-to-reduce-risk/

- Ernst & Young. (2019). Crypto assets: The global regulatory perspective. Retrieved from https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/banking-and-capital-markets/ey-crypto-assets-the-global-regulatory-perspective.pdf?download

- Risk Publishing. (n.d.). How to conduct a great crypto risk assessment. Retrieved from https://riskpublishing.com/how-to-conduct-a-great-crypto-risk-assessment/

- SmartAsset. (n.d.). Financial risk management. Retrieved from https://smartasset.com/financial-advisor/financial-risk-management

- Bybit. (n.d.). Crypto trading risk management. Retrieved from https://learn.bybit.com/trading/crypto-trading-risk-management/

- Coin Insider. (n.d.). Risk management in crypto trading. Retrieved from https://www.coininsider.com/risk-management-in-crypto-trading/