How To Buy & Sell Cryptocurrency

Where to start

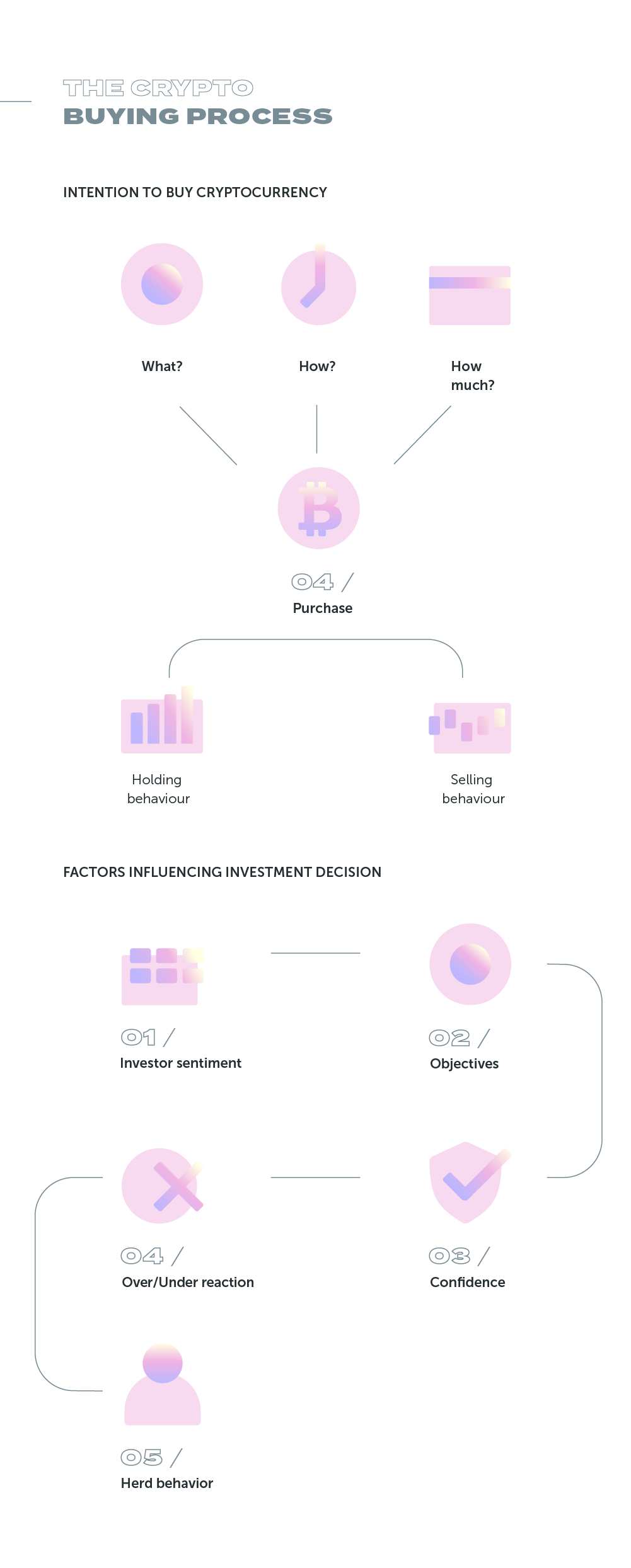

Buying cryptocurrencies is one of the main obstacles that keeps bitcoin and digital assets far from being mainstrean, especially given the complexity of navigating digital exchanges, managing digital wallets and choosing the right asset for your investment goals.

Indeed, buying (and therefore selling) a cryptocurrency is not as simple as buying stocks or securities: unless you're an experienced trader, it is a complex procedure that requires a degree of confidence and knowledge with the technology behind, which rules a considerable range of investors out from the cryptocurrency universe.

To own cryptocurrency, it is compulsory to master basic functions without the help of a financial intermediary: buying, storing, transferring and selling.

Things to Check Before Buying

Buying crypto will eventually require to evaluate some features stand out as very important or extremely important to most buyers:

Buying what?

There are more than 15,000 cryptocurrencies nowaday that can be broadly categorised into four types:

- Digital Coins - These include cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH) that are intended to function as a currency, a method of payment, a store of value, as an investment asset or a speculative investment. Digital coins reside on a blockchain that doesn’t do anything other than record and execute transactions, as they have no function to distort their trade value. Once purchased, coins can be stored in password-protected digital wallets.

- Security Tokens - These tokens represent the ownership of a digital or even physical asset, such as participation in real physical underlyings earnings streams, companies, or entitlement to interest payments or dividends. In terms of economic function, they are the same as bonds, derivatives, and equities, except that you receive a digital certificate of ownership stored on a blockchain rather than any physical asset. Security tokens are usually issued when a company launches an Initial Coin Offering (ICO) to raise capital for its project. Asset-backed tokens, equity tokens, and debt tokens are the three primary forms of security tokens.

- Utility Tokens - These are digital tokens that are used for a blockchain-based product or service and do not represent any ownership stake in the project being invested in. Investors may purchase these utility tokens in different cryptocurrencies or even fiat currencies, and prices are generally static during the initial stages. These tokens, once purchased, may be used for investment or to access services provided by the blockchain project.

- Stablecoins - These are are essentially a form of digital assets that derives its value from some underlying external asset, such as a national currency – like Tether (USDT) and the Gemini Dollar (GUSD) – or the price of commodities like gold. Stablecoins can be also crypto-collateralized when are backed by a crypto-currency like DAI or Algorithmic/Non-collateralized when they rely on a smart contract to buy/sell the stablecoin in order to keep the price constant, like SagaCoin (SAGA), Havven (HAV), and Carbon (CUSD).

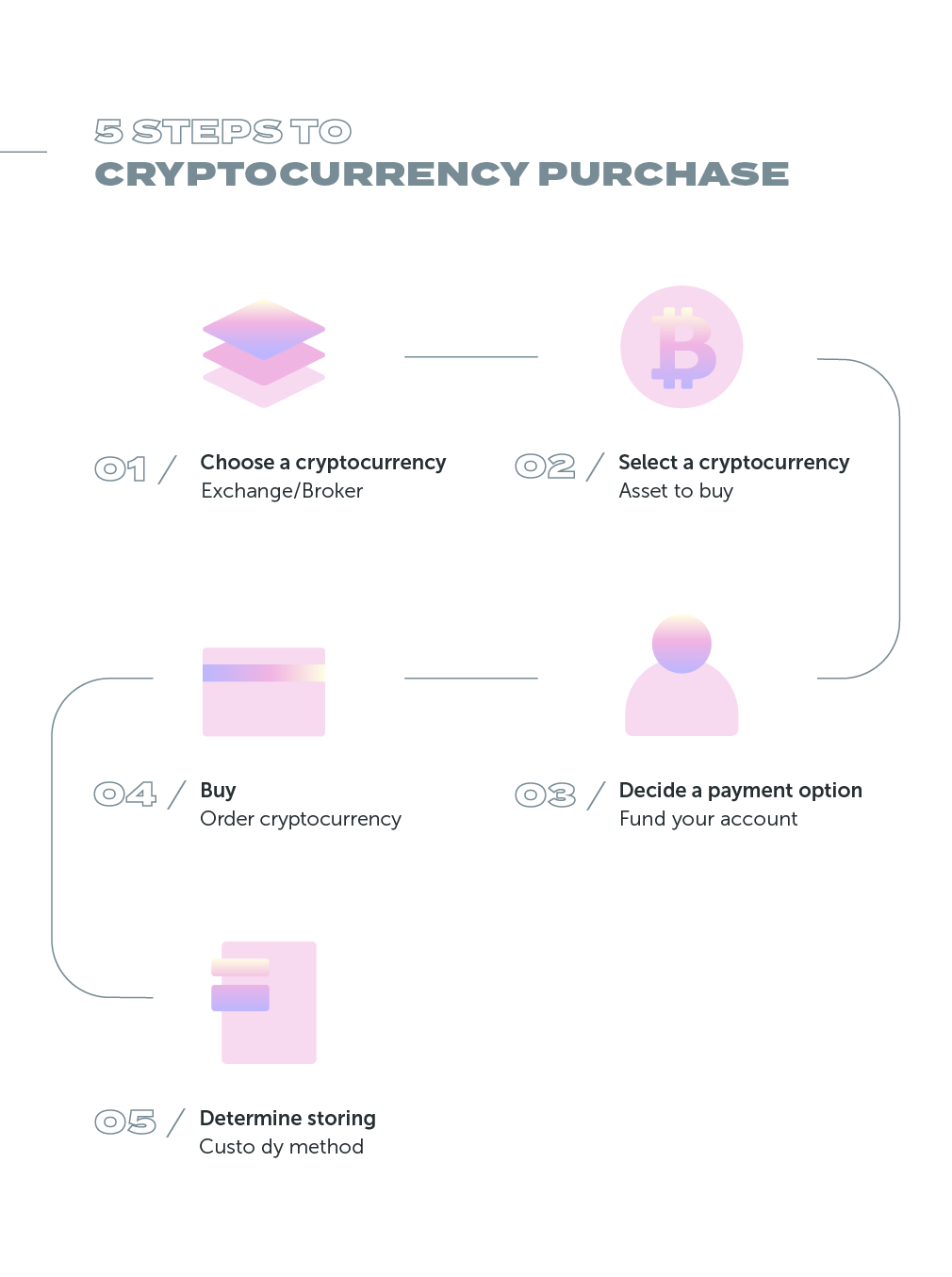

Where to Buy Crypto?

The most common and easiest ways for investors to enter into the securities market is through:

- Crypto exchanges

The most popular and easy way to obtain crypto is through centralized exchanges, platforms where buyers and sellers meet to exchange coins, charging small withdrawal fees (ranging from roughly 0.05-5.00%) on each transaction. Users can trade cryptocurrencies for others, or buy crypto using fiat currencies and/or stablecoins.

Coinbase is one of the best known exchange platforms in the world active on Bitcoin, Ethereum and Litecoin. Kraken ranks as the first virtual price list for Bitcoin transactions in euros. Poloniex offers the possibility of exchanging over one hundred cryptocurrencies with a fixed commission of 0.2% on all transactions.

When choosing a cryptocurrency exchange, it’s crucial to consider fees, cryptocurrencies offered, how cryptocurrency is stored and whether is transferrable to an external digital wallet.

- Alternative ways

Buying cryptocurrency on exchanges is not the only way to own cryptocurrency. Other ways to acquire cryptocurrency include:

- Participation in the network (mining and staking);

- Airdrops (when a startup gives away coins and tokens to raise awareness);

- Faucets (websites that distribute small quantities of crypto for free);

- Bitcoin ATMs;

- DEXs/P2P exchanges that lets users purchase and sell cryptocurrency directly from each other;

- Financial & Trading Apps that allow to buy cryptocurrency such as PayPal and Venmo, Webull or Robinhood;

- Traditional brokers, including Interactive Brokers and TradeStation;

- and more.

Storing/Custody

Before buying cryptocurrency it is essential to establish a way to custody assets, transferring it to a safe storage such as a crypto wallet.

Storing Bitcoin on a third-party service like centralized exchange is subject to several risks, including counterparty risk, the risk of hacking and robbery and the risk of rehypothecation.

To mitigate all these events, Bitcoin owners may choose a self-hosted wallet to custody their Bitcoin holdings.

Transferring

Transferring crypto implies moving coins to an external wallet or another exchange through a blockchain transaction.

In order to move any crypto from one source to another, you would need a “destination address”, a digital location made of unique string of letters and numbers which indicates where you would like to send your crypto. Crypto wallet addresses can also be displayed in QR code format.

Once you have the destination address, to transfer your crypto you simply have to fill the amount to transfer and the recipient's address into the withdrawal clipboard of the wallet app you're using.

But beware: transactions are irreversible, so if you send to the wrong address, you'll most likely never see that bitcoin again.

Selling

When you decide you’re ready to sell your Bitcoin, you can place a sell order through centralized or decentralized/peer-to-peer exchanges, much like you did when you originally purchased it.

Most exchanges offer several different types of orders, so you can decide to set selling or buying parameters or the conditions under which you are willing to buy/sell, determining both the price and the amount. Once the sale goes through, you can transfer the money to your bank account.

Remember that selling crypto makes it subject to capital gains taxes.

Taxation

Cryptocurrency taxation varies in different countries.

One of the most important things in cryptocurrency trading is to keep track of all transactions and potentially taxable activities (when was the transfer made, in what amount, for what goods or services, etc.) to simplify your reconciliation process.

If you leave your virtual currency within your account on the exchange you buy it, it’s generally easy to track or generate reports about your transactions. But if you move your currency between private wallets or you have crypto in multiple places, you’ll need to be more diligent in your tracking. There are crypto-focused tax software programs – CoinTracker, TokenTax, CryptoTrader.Tax and more – you can use to simplify the process.

Keep in mind that converting one cryptocurrency to another cryptocurrency (e.g. bitcoin to ether) may be considered taxable in some jurisdictions. Spending cryptocurrency or paying for goods and services with crypto may also be taxable as it constitutes a sale of the cryptocurrency. “Whenever you sell the investment, or exchange the investment for another investment, that is when a taxable transaction happens,” says Daniel Johnson, a financial advisor and founder of RE|Focus Financial Planning in Asheville, North Carolina. “You’ve got to be careful if you’re doing a lot of trading. If you’re going in and out of different types of cryptocurrency, every single time you place that trade, it is a taxable event.”

References

- World Economic Forum (WEF), “Cryptocurrencies: A Guide to Getting Started”, June 2021.

- Nòva24 - Il Sole 24 Ore, “Bitcoin Generation”, 2018.

- Martin Thoma, “The 7 Types of Cryptocurrencies You Must Know”.

- Forbes, “How To Safely Self-Custody Your Bitcoin”.

- SmartAsset, “Crypto Asset Allocation: 2022 Investment Guide”.

- Exodus, “What are the different types of cryptocurrencies?”.

- Blockchain Council, “Security Tokens Vs. Utility Tokens : A Concise Guide”.

- Bankrate, “How to buy Bitcoin: 5 ways to add the popular cryptocurrency to your portfolio”.

- Time.com, “Yes, Your Crypto Is Taxable. Here’s How to Report Cryptocurrency to the IRS in 2022”.