How to Invest in Cryptocurrency

Introduction

Investing in crypto assets can be extremely profitable but, much like trading stocks, an in depth knowledge of the market strengths, weaknesses and growth prospects and its unique risks are strongly requested.

Cryptocurrency are so profitable because of their volatility. Market is characterised by sudden price movements – meaning that the prices of assets can increase and decrease in price dramatically over the short term – and speculative behavior by experienced traders and investors who assess market conditions and buy or sell assets accordingly, based on how they think the factors at play will affect prices.

Before engaging in any kind of cryptocurrency trading and investing, it is fundamental to get educated and build up appropriate knowledge and understanding of the asset class.

Things to Learn before Starting

Before advancing, it’s essential to fully grasp each of these concepts:

Creating a cryptocurrency investment plan

To start investing in Bitcoin or other digital assets, it’s important to develop an investment plan by:

- Assess your current financial situation and set a budget;

- Define specific goals to achieve in the short and long term;

- Research and evaluates different investment opportunities (types of assets, as well as trusted exchanges and crypto storage options) that fit your goals;

- Outline how much to invest and how to allocate funds accordingly;

- Determine your risk tolerance and time horizon.

Trading VS Investing

Trading and investing are two different approaches to the cryptocurrencies market. Both involve seeking profit, but they pursue that goal in different ways. Which is better depends largely on time commitment and tolerance for risk.

- Investing typically involve buying an asset that will rise in value over time, holding positions for the longer term (years) and through the natural short-term ups and downs of the market with the goal of selling it later at a higher price. The main way to investing is to buy coins on crypto-exchanges or purchase coins that are newly released in an initial coin offering (ICO). Alternatively, you can invest in crypto funds and companies.

- Trading involve buying or selling an asset on small price movements with the goal to capture price momentum and reach profits over short periods. Day trading and scalping strategies are utilised to capture profits in minutes or hours, sometimes even seconds with timing market moves. Trading essentially consists in exchange fiat money (like the US Dollar) for cryptocurrency by buying at the most appropriate time. Several platforms also allow to short selling through the stock lending provided by the same platforms. The most important platforms for trading Bitcoin and other cryptocurrencies are Bitmex, Bitfinex, Coinbase Pro, Kraken and Bitstamp.

Diversification

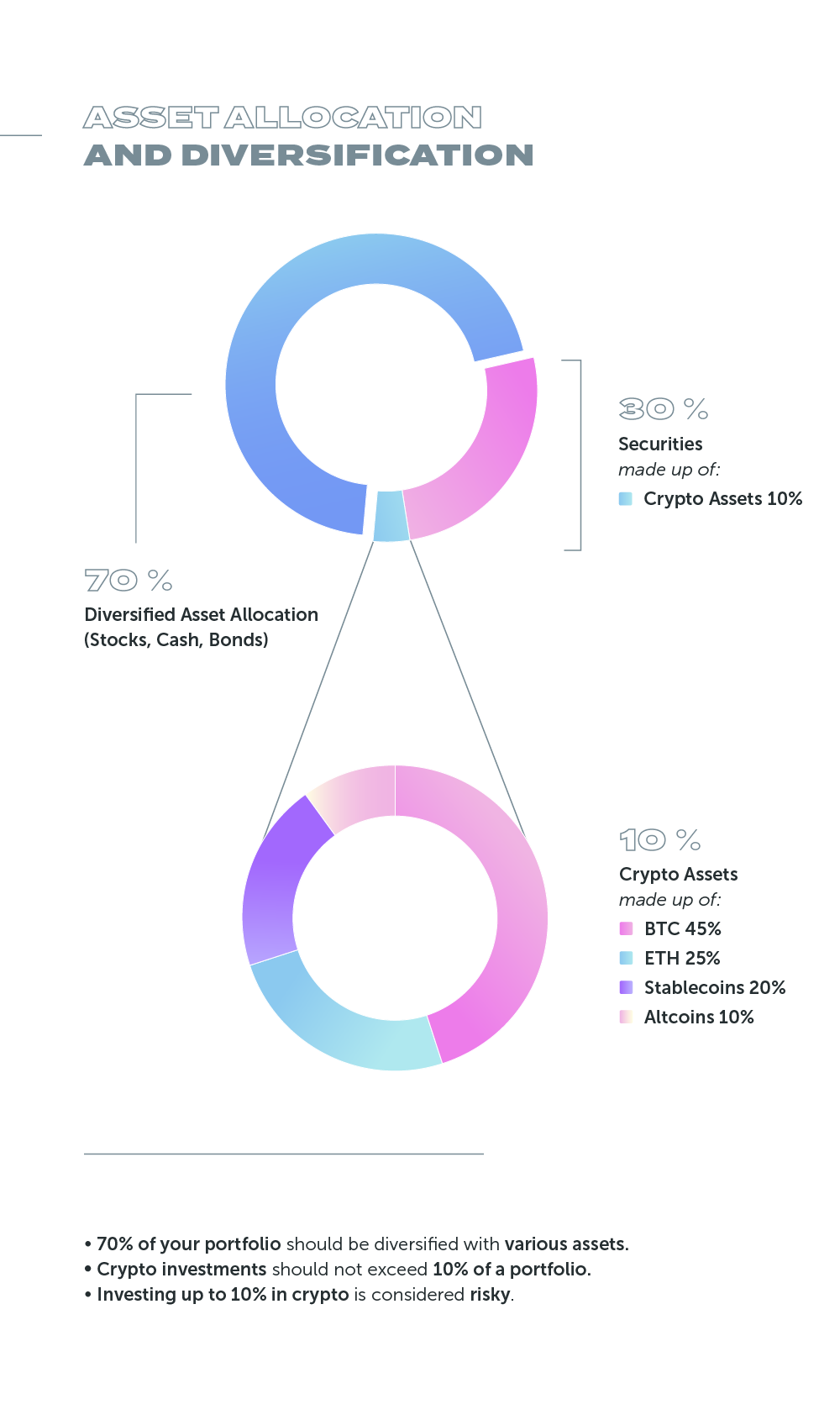

Every investor wants to achieve the highest possible long-term returns without taking extreme levels of short-term market risk. However, risk and reward are positively correlated in investing. Chosing low-risk investments – such as bonds or cash – usually means lower returns, while high-risk investments – like stocks – gives higher returns. To overcome this issue, any investment in crypto assets should only be considered as a very small component of an investor’s overall diversified portfolio.

Following Harry Markowitz’s Modern Portfolio Theory (MPT), investors can create a balanced portfolio that provides the highest rate of return balancing an acceptable level of risk risk and reward. Under the model, an investor can reduce a portfolio’s risk by simply holding a diversified combinations of assets that are not perfectly positively correlated. The key is to identify investments in segments of each asset category that may perform differently under different market conditions.

For many financial goals, investing in a mix of assets can be a good strategy. By picking the right group of investments, investors may limit losses and reduce the fluctuations of investment returns without sacrificing too much potential gain.

Asset allocation

Given the very high volatility of the sector, investors should consider carefully whether such an investment is appropriate for their circumstances. In determining their asset allocation, investors must consider their financial circumstances and goals, time horizon, risk tolerance and the principles of traditional asset allocation.

According to Bitwise’s white paper “The Case For Bitcoin in an Institutional Portfolio”, investors allocating to bitcoin must answer three critical questions:

- What is the minimum acceptable holding period for a bitcoin allocation?

- What is the best rebalancing frequency for a bitcoin allocation?

- How much bitcoin should you add to a portfolio?

To answer the first question, the holding period of a bitcoin allocation goes to two years and higher, while the frequency of positive contributions quickly approaches 100%.

Regarding the substantial impact that a rebalancing strategy can have on bitcoin’s impact on a portfolio, as might be expected with a highly volatile but upwardly biased asset, lower rebalancing frequencies generally lead to higher volatility, higher cumulative returns, and significantly higher maximum drawdowns. Conversely, more frequent rebalancing strategies dampen both the volatility and return impact.

Perhaps the most important question when allocating to crypto is, how big a position should you have? Clearly, as allocation increases, the portfolio’s volatility does as well. Small allocations – roughly between 0.5% and 3.0% – have a minimal impact on portfolio volatility, but that the impact increases quickly as the size of the allocation goes up. Above a 3%, meaningfully increases the portfolio’s volatility.

While it depends on who you ask, it’s generally recommended that speculative investments should not exceed between 5-10% of a portfolio (depending on your risk preferences and investment goals).

Monitoring and Rebalancing

Many financial experts recommend investors to monitor and rebalance portfolios to check whether you're on track to reach your financial goals.

Rebalancing – or adjusting the weightings of your originally planned strategic asset allocation in your investment portfolio – can be set on a regular time interval, such as every six or twelve months to maintain your desired level of risk and return over time.

Others recommend rebalancing only as the prices of individual investments fluctuate or when your allocations have deviated from the ideal portfolio mix. The advantage of this strategy is that your investments tell you when to rebalance. In either case, rebalancing tends to work best when done on a relatively infrequent basis.

Beginner’s strategy: buy and secure

You can trade in cryptocurrencies on multiple levels.

Beginners usually start by activating an account on one of the most used specialized exchanges such as Coinbase, Bitstamp, Kraken, Bithumb etc or decentralized exchanges, such as Bitshares and Etherdelta.

Exchanges usually offer only a limited amount of coins: for example, Coinbase provides Bitcoin, Ethereum, Dogecoin and Litecoin. To operate on the exchanges it is necessary to register, providing identity and a deposit account.

Once purchased, cryptocurrencies can be left in custody on exchange wallets – which doesn’t provide protection against theft, hack or loss – or transfer the bitcoins into a self-hosted wallet.

Advanced strategy: diversification

More advanced investors usually use advanced cryptocurrency trading platform such as Coinbase Pro (formerly known as GDAX) to buy Bitcoin, Ethereum and Litecoin and then transfer part of these cryptocurrencies to another exchange to buy alternative coins in order to build a well-diversified and blanced portfolio with other potentially lucrative assets like altcoins, decentralized finance projects, and NFTs.

At this point, the choice is between day trading or long-term investing. NFTs and Bitcoin may very well be considered some of the best strategies for long-term crypto holders. In the other case, platforms such as OKEx, Bitfinex, Binance, Ubbit and Bithumb appear in the top ten for daily volumes and exchanges. Always keep in mind to make research and never risk more than you are willing to lose.

References

- World Economic Forum (WEF), “Cryptocurrencies: A Guide to Getting Started”, June 2021.

- Nòva24 - Il Sole 24 Ore, “Bitcoin Generation”, 2018.

- Betashares, “The Investor’s Guide To Crypto” available at https://www.betashares.com.au/files/collateral/brochure/Investors-Guide-to-Crypto.pdf

- Bitwise, “The Case for Crypto in an Institutional Portfolio” available at https://static.bitwiseinvestments.com/Research/Bitwise-The-Case-For-Crypto-In-An-Institutional-Portfolio.pdf

- Gemini, “Healthy Volatility and Its Implications for Crypto Markets”, available at https://www.gemini.com/cryptopedia/volatility-index-crypto-market-price#section-crypto-market-volatility

- The Balance, “What Is Modern Portfolio Theory (MPT)?”, available at https://www.thebalance.com/what-is-mpt-2466539

- Galaxy Digital Research, “A Modern Portfolio Theory Case for Bitcoin”, available at https://medium.com/galaxy-digital-research/a-modern-portfolio-theory-case-for-bitcoin-c6d6ba609efa

- Carter Kilmann, “Yes, You Still Need an Investment Plan for Trading Cryptocurrencies”, available at https://medium.com/the-post-grad-survival-guide/yes-you-still-need-an-investment-plan-for-trading-cryptocurrencies-1f13b9bb936d

- Investor.gov, “Beginners’ Guide to Asset Allocation, Diversification, and Rebalancing”, available at https://www.investor.gov/additional-resources/general-resources/publications-research/info-sheets/beginners-guide-asset

- Goldman Sachs, “Crypto: a new assett class?”, available at https://www.goldmansachs.com/insights/pages/crypto-a-new-asset-class-f/report.pdf