A Primer on Stablecoins: What are They and How do They Work?

Stablecoins have recently become an interesting phenomenon in the ever-developing world of digital currencies. This is because they are palatable to those that are novices to the cryptocurrency environment, but also because of interesting aspects regarding their regulatory landscape, considering that high ranking politicians and officials have seriously started considering the best way to handle them in the future. In order to get a full view on the current regulatory atmosphere surrounding stablecoins, it is important to first differentiate them from other digital asset.

Why stablecoins are different from other cryptocurrencies

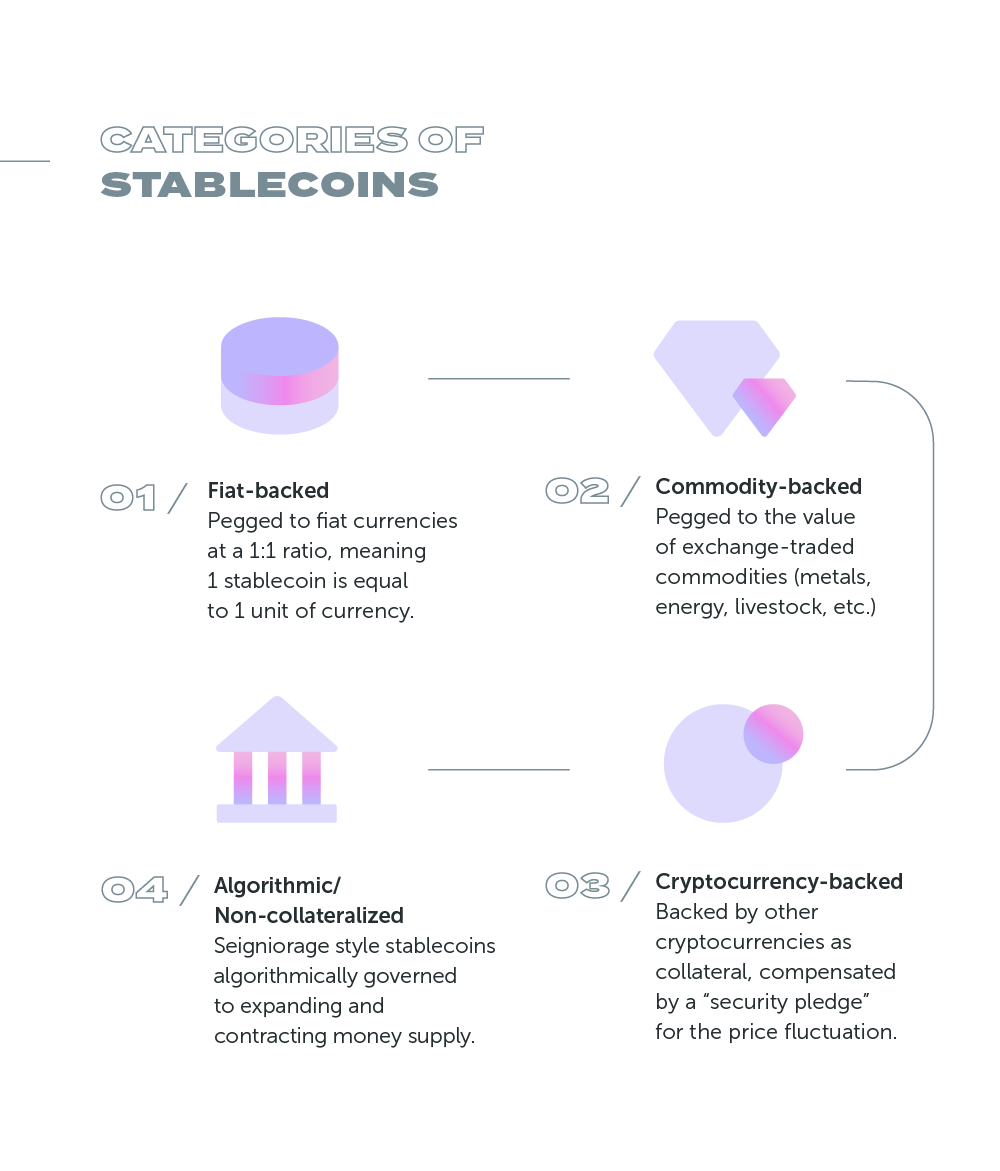

Stablecoins are essentially a form of digital assets that derives its value from some underlying external asset, such as a national currency (ex. US Dollar or Euro), or the price of gold. This makes them different from cryptocurrencies like Bitcoin that are “mined” by computers. Therefore, while Bitcoin and Ethereum, for example, rise and fall in a very sporadic manner, stablecoins “promise to maintain their value”, for the precise reason that they are pegged to these less volatile assets.

Moreover, not only are stablecoins different from other cryptocurrencies, but they are actually primarily used, at least in the United States, to facilitate the movement and lending of other digital assets on trading platforms.

The risks associated with stablecoins

According to the US Treasury, when stablecoins are involved in speculative digital asset trading, it may be possible that risks related to investor protection and fraud will arise. The Treasury also indicated issues linked with stablecoins’ lack of regulation, stating that they “pose illicit finance concerns and risks to financial integrity, including concerns related to compliance with rules governing anti-money laundering.”

There have also been tangible negative repercussions for stablecoin issuers. Take for example Tether - which issues Tether stablecoins - that agreed to pay $18.5 million in fines last February after New York State Attorney General Letitia James charged them with hiding “massive losses”.

The positive aspect of stablecoins

Even though the US Treasury has repeatedly warned the public of the risks associated with stablecoins, Secretary Janet Yellen also recently stated that stablecoins were well designed and may well become beneficial payment options in the future. This positive take is probably due to the fact that, as previously mentioned, stablecoins have the benefit of being directly backed by some sort of asset, be it gold, cash or others, and are therefore supposed to be much less volatile than other cryptocurrencies.

Most beginners in the crypto world find stablecoins easier to understand and also find them to be more practical, simply for the fact that they help them to avoid trading fees. In fact, most crypto exchange platforms, including more well known ones like Coinbase, do not charge any fees when exchanging US Dollars for stablecoins