Blockchain and crypto space takes hit, still sees big deals, KPMG says

The auditing firm sees the growing maturity of the crypto space, despite a slowdown in interest and investment is expected.

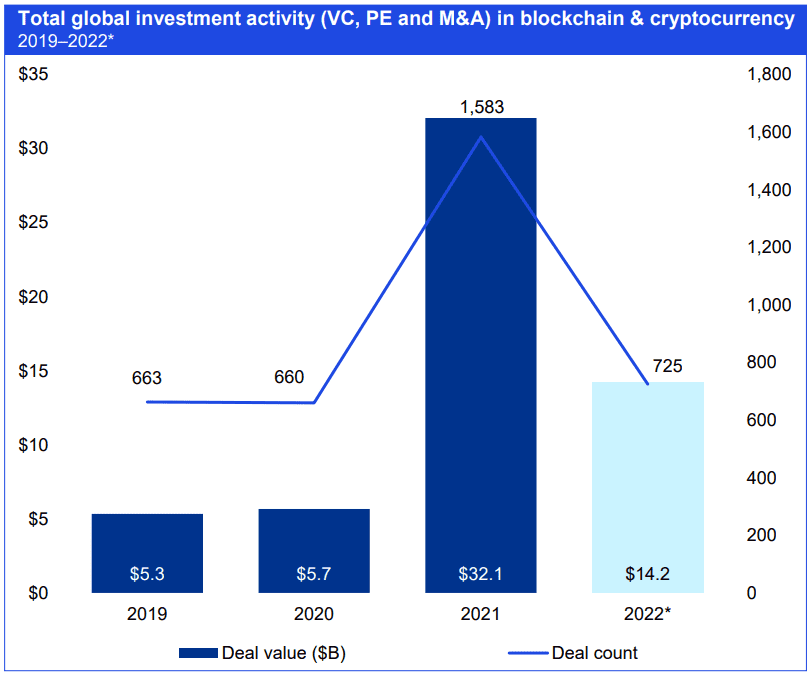

Despite the crypto space experienced significant challenges during the first half of 2022, crypto-focused companies attracted $14.2 billion during H1’22. But according to a report from accounting firm KPMG, a slowdown in crypto interest and investment is expected (particularly retail firms offering coins, tokens and NFTs), while there will likely be a continued focus on the use of blockchain in financial market modernization.

Investment in crypto and blockchain falls from 2021 high, remains ahead of all other years

“Despite the crypto space collapsing significantly since mid-way through Q1’22 due to the unexpected Russia-Ukraine conflict, rising inflation, and the challenges experienced by the Terra crypto ecosystem, investment at mid-year remained well above all years prior to 2021. This highlights the growing maturity of the space and the breadth of technologies and solutions attracting investment,” KPMG said in the report.

Among the Key H1'22 highlights from the crypto and blockchain space, the accounting firm points out at the changing nature of investors shifting crypto investment risk profile, “with institutional and corporate investors now accounting for a much larger share of investments”, and the increasing interest in the use of cryptocurrencies in order to support crypto sovereignty and move away from the use of existing currencies like the US Dollar. “This has driven significant changes to the perception of risk related to crypto assets. While crypto assets historically were considered quite uncorrelated to traditional assets from an investment risk perspective, they are now acting very similarly. The current macro-economic trend will likely be an important test for cryptos, and especially Bitcoin, in terms of correlation with other assets,” explain KPMG.

During H1’22, the largest deals in the space came from VC raises, including a $1.1 billion raise by Germany-based Trade Republic, a $550 million raise by US-based Fireblocks, a $500 million raise by Bahamas-based FTX, and a $450 million raise by ConsenSys.

Regulators continuing to focus on crypto regulation

KPMG forecast “more changes” over the next 12-24 months for regulations related to cryptocurrencies as “regulators in a number of other jurisdictions have continued to focus on finding ways to protect consumers while also fostering the evolution and growth of competitive and attractive crypto markets.”

What to watch for in H2'22

Finally, KPMG predicts that resilience of crypto-focused companies will be “tested very hard” in the near future as some look to recapitalize at lower valuations. According to the firm, “well-managed crypto companies with healthy risk management policies, long-term vision, and strong cost and risk management approaches” will survive the bear market, “while others bust.”

“Looking ahead, we are going to see some cryptos cutting their valuations and working to raise money because it’s their only option. They’d rather raise money and be capitalized at a lower valuation rather than not doing so and taking the risk of dying out,” said KPMG France Director blockchain & crypto assets Alexandre Stachtchenko. “Of course, some cryptos will die out — particularly those that don’t have clear and strong value propositions. That could actually be quite healthy from an ecosystem point of view because it’ll clear away some of the mess that was created in the euphoria of a bull market. The best companies will be the ones that survive,” he added.