CoinGecko Report Unearths Alarming 50% Fatality Rate for Cryptocurrency Tokens in the Last 10 Years

Analysis shows bull runs fuel surge in cryptocurrency deaths, highlighting the volatility of the digital asset landscape.

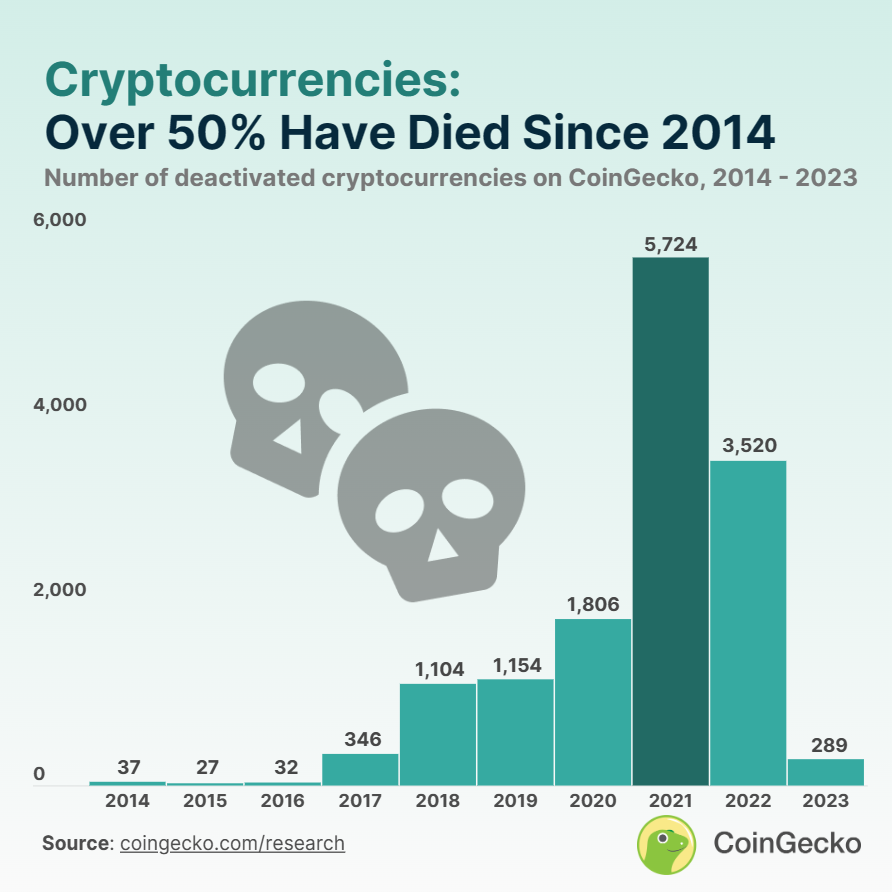

In the last ten years, CoinGecko has monitored the lifecycle of every cryptocurrency token that has entered the market. Astonishingly, about half of these are now extinct.

Since 2014, CoinGecko has listed 24,000 cryptocurrency tokens, out of which 14,039 have become obsolete, as per the platform’s analysis.

The bull run of 2020-2021 proved to be the most lethal for digital assets, recording a staggering mortality rate of 70%. Out of more than 11,000 tokens listed during this period, 7,530 have become extinct.

A trend of high failure rates has been observed during bull runs, serving as a warning for investors. Tokens experience the highest failure during bull markets, with dead tokens surging by 1,000% during the 2016-2017 bull run and increasing about fivefold in the 2020-2021 boom cycle. On the contrary, during bear markets, investors tend to take fewer risks, and projects are less likely to be launched and subsequently fail.

This pattern also highlights that attractive trends may be ephemeral, particularly during favorable market conditions. Projects can be quickly discarded, and traders may shift to other networks.

CoinGecko emphasizes three criteria to declare a token dead: lack of trade activity in the past 30 days, projects exposed as scams or rug pulls, and when a project requests deactivation.

Interestingly, the count of dead tokens saw a sharp decrease in 2023. Out of 4,000 listed tokens, only 289 have died, accounting for less than a 10% death rate.

The overall death rate of tokens is consistent with the failure rate of startups. As per a 2019 report by Startup Genome, approximately 90% of startups do not survive.