JPMorgan's survey found 72% of institutional traders skeptical towards crypto assets

The survey conducted by JPMorgan has shown a conflicting view towards crypto assets among institutional traders.

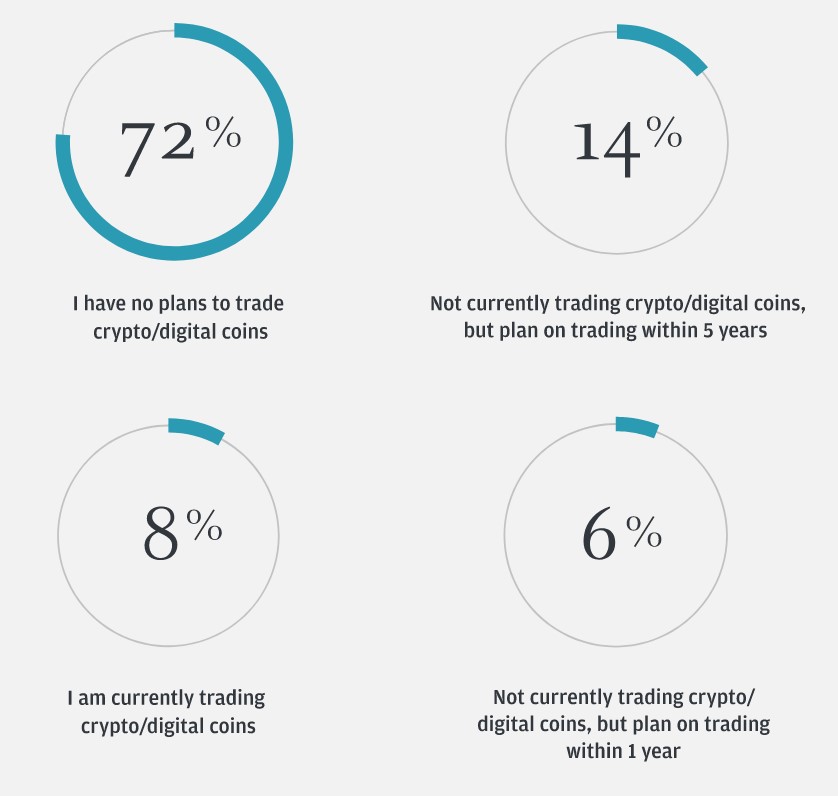

According to a survey by JPMorgan, 72% of institutional e-traders have indicated they have "no plans to trade crypto/digital coins" in 2023. The survey, the seventh edition of JPMorgan's e-Trading Edit, polled 835 traders from 60 global locations to understand the factors that will impact trading performance in 2023.

The survey – which was conducted from Jan. 3 to Jan. 23. – found that 100% of traders predicted an increase in electronic trading activity, including crypto, commodities, and derivatives. About 58% of traders also predicted an increase in the volume of crypto traded on e-trading platforms in 2023, with the figure expected to rise to 69% in 2024.

However, the survey showed a cautious approach among traders towards digital assets. Only 14% of traders said they would either continue trading in the digital asset market or start trading this year. Another 14% said they were not currently trading crypto but planned to do so within 5 years, while only 8% reported that they are currently trading digital assets. The overwhelming majority of institutional traders (92%) reported not having any exposure to the digital asset market in their investment portfolio at the time of the survey.

The survey results follow a downturn in investor and trader sentiment towards the cryptocurrency market after the Terra (LUNA) ecosystem and the FTX trading platform experienced major collapses in 2022.