Mining Competition Increases while Profitability Decreases, Glassnode reports

The latest report by Glassnode shows that while hashrate registered an all-time high, miner revenue’s is at a low point, suggesting "heightened probabilities of volatility on the horizon".

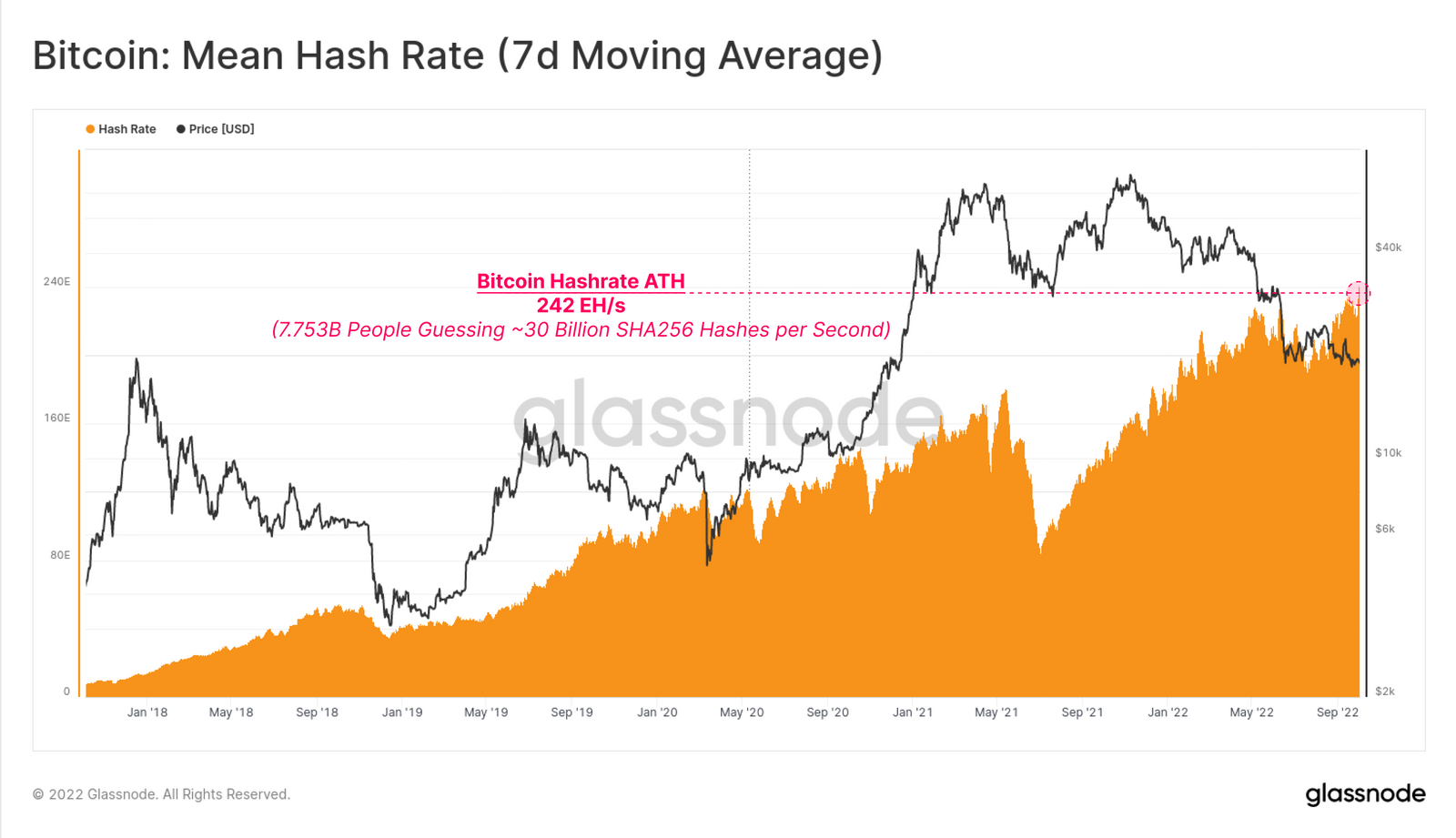

Despite severe price drawdowns, and global macro turmoil, Bitcoin hashrate has remarkably pushed to yet another all-time high of 242 Exahash per second this week, the latest Glassnode insight reports.

These are extraordinarily large numbers, “equivalent to all 7.753 Billion people on earth, each completing a SHA-256 hash calculation approximately 30 Billion times every second,” Glassnode explains, highlighting that mining difficulty has “risen 27.9% since the Great Miner Migration peak in May 2021”.

According to the report, higher protocol difficulty implies “an increasing cost of production per unit of BTC as more hashpower competition enters the network”. This, the report shows, is occurring at a time where miner revenues are already stressed due to lower coin prices, which should, in theory, create elevated income stress on the mining industry. But Bitcoin prices remain remarkably stable, in a multi-month consolidation between $18k and $20k. It is extremely rare for BTC prices to stay so stationary for long, suggesting heightened probabilities of volatility on the horizon.

“The Bitcoin hash-ribbons commenced an unwind in late August, providing an indication that mining conditions were improving, and hashrate was coming back online,” the report shows, suggesting that “almost all historical hash-ribbon unwinds have preceded greener pastures in the months that followed.”But the current environment “has not yet seen prices recover, signalling this hashrate rise is due to more efficient mining hardware coming online and/or miners with superior balance sheets having a larger share of the hashpower network.”

Glassnode noted that a 66% increase in difficulty and hashrate since Oct-2020 corresponds to an approximate halving in revenue per hash. “Bitcoin mining hashrate reached new all-time-highs this week, driving up the cost of production for BTC, at a time where miner revenues have only just recovered from the recent capitulation. By numerous models, we estimate that the average cost of BTC production hovers just below current prices, such that any significant price decline could turn an implied income stress, into acute and explicit stress,” the report concluded.