What is the hash rate of Bitcoin

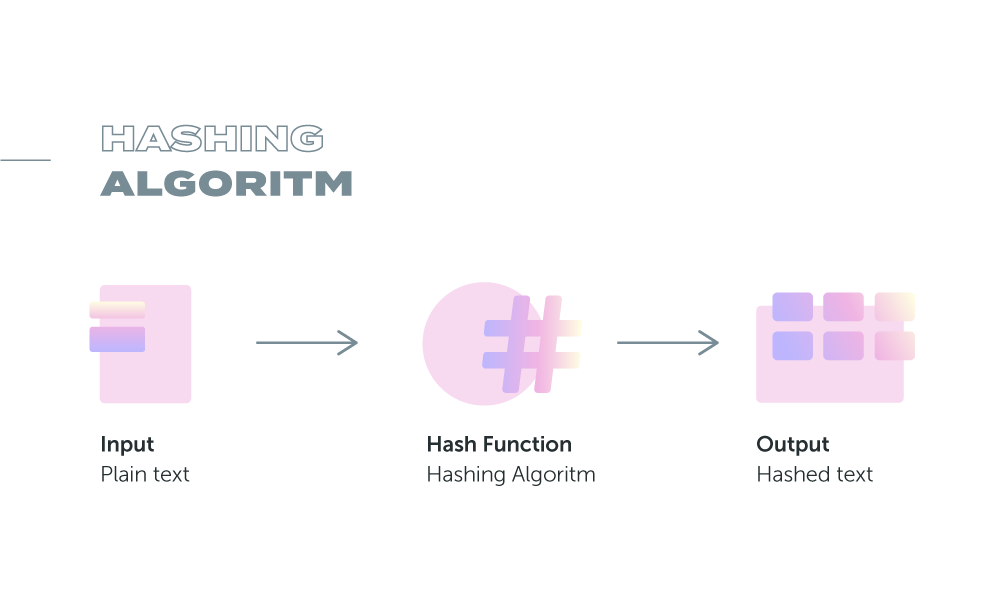

What Is Hashing in Blockchain?

Encryption and decryption are fundamental concepts in the world of cryptocurrencies. In their simplest form, they describe the process of transforming data by using complex algorithms – which can be solved only with the possession of a secret key, or with advanced computational power – to scramble and thereby changing them from a readable to an unreadable form.

Cryptocurrencies use Hashing Algorithms – a mathematical function that is easy to perform, but extremely difficult to reverse – to write new transactions, timestamp them, and ultimately to add a reference to them in the previous block. Whereas encryption algorithms are reversible (with the key) and built to provide confidentiality, hashing algorithms are a one-way irreversible cryptographic function (as the original data cannot be retrieved via decryption) built to provide authenticity and integrity in order to certify that a particular piece of data has not been modified. Besides maintaining data privacy, cryptography prevents anyone from deleting or changing a record once it has been created on a blockchain or ensure that currencies can only be spent by their rightful owners.

Hashing is therefore crucial to maintain the cryptographic integrity of the blockchain.

Cryptographic Hash Functions

Blockchains rely heavily on hash functions for generating cryptographic keys and hashing the transaction blocks.

A hash is a fixed-length alphanumeric code used to represent words, messages, and data of any length, converting them into data of fixed length (for instance, 128, 256 or 512 characters). For any given input, the output will always be the same.

Basically, hash functions take in an input of any length called the message or data, apply a mathematical function on this input and generate a fixed-length alphanumeric code called a hash digest or just “hash”. The aim of a hash function is to make as hard as possible to find a relationship between the input value and the output. Note that the same input will always produce the same output, but even a small change to the input will result in a completely different output. This property is known as the hash function's collision resistance and makes it useful for verifying the integrity of data.

Cryptocurrencies use a variety of different hashing algorithms to create different types of hash code. SHA-256 or the Keccak-256 hash function, for instance, take in the input of any length and converts it into 256 bytes.

How Hashing Works In Blockchain

In blockchain, hashing is used to secure the integrity of the data stored in blocks. Each block in a blockchain contains a unique code, called a hash, that is generated using a mathematical function. This function takes the data in the block, including transactions, as input and produces an output, the hash, that is a fixed length and unique to the data in the block. Using a fixed-length output increases security since anyone trying to decrypt the hash won't be able to tell how long or short the input is simply by looking at the length of the output.

When a new block is added to the blockchain, the hash of the previous block is included in the data of the new block. This creates a chain of blocks, each containing the hash of the previous block. This chain is what makes the blockchain secure and tamper-proof. Because each block's hash is dependent on the previous block's hash, any change made to a block will change its hash, and this will be detected as invalid by the rest of the network.

In summary, hashing plays a crucial role in the security and integrity of blockchain, as well as in the mining process of cryptocurrency. It helps to ensure the immutability of the data stored in blocks and the secure link between blocks in the chain.

How Hashing Works in Cryptocurrencies

Block hashing is a core concept of Bitcoin mining and is a central component of how cryptocurrencies work.

In cryptocurrency mining, hashing is the process of ensuring the validity of network transactions. Every time someone purchases a token or uses it as payment, the transaction is recorded on its blockchain. Miners competes with each other to validate transactions and add them to the blockchain network in return for a reward, processing the data from a block through a mathematical function, which results in an output of a fixed length.

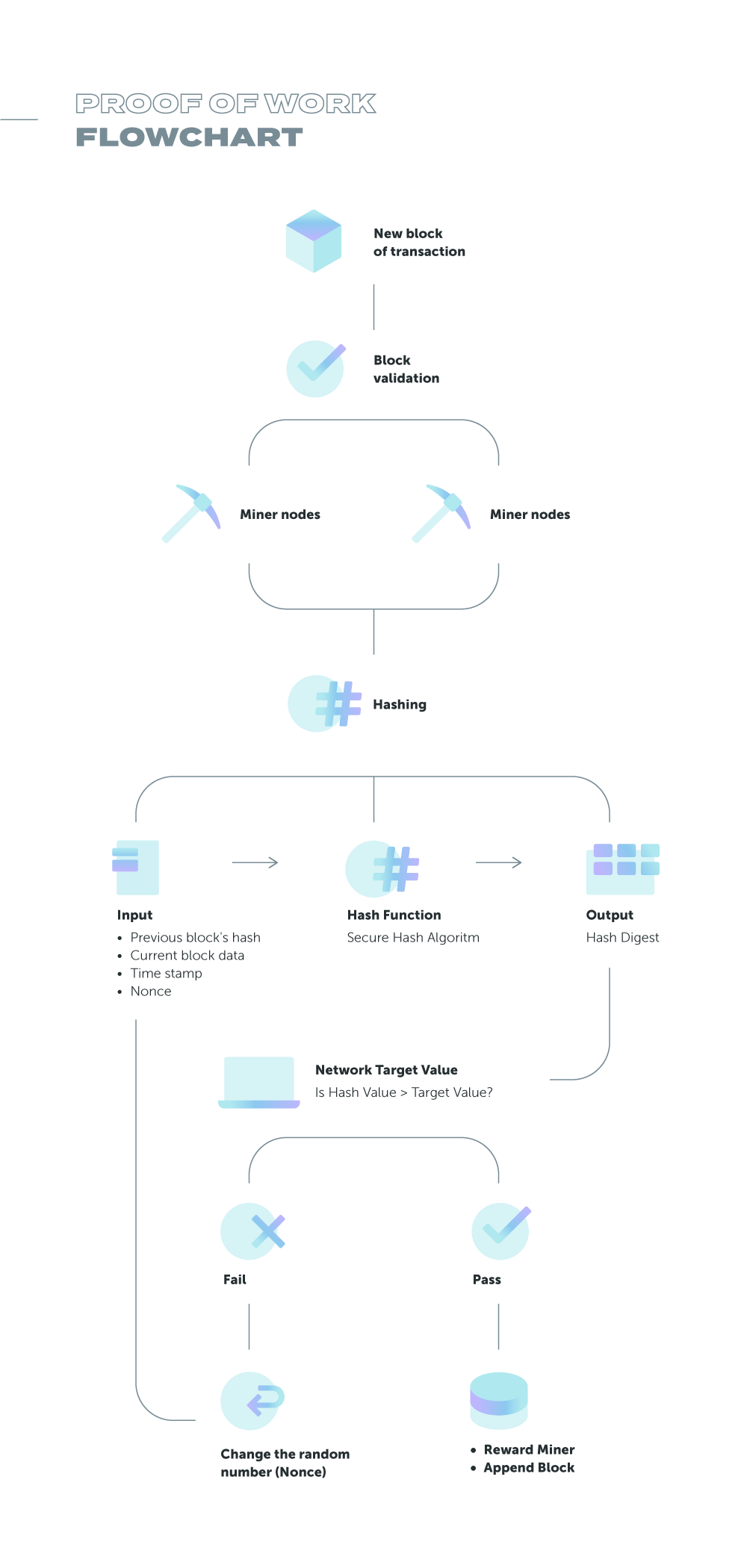

In the case of Bitcoin, mining is essentially conducted by running a series of SHA-256 hashing functions, and the miner's task is to produce a fixed-length alphanumeric code (or a “hash”) that meets certain criteria set by the cryptocurrency's consensus algorithm, verifying a large number of guesses. The process is known as mining or Proof-of-Work (PoW) and it involves repeatedly hashing the block's data, including the previous block's hash, until a valid hash is found that meets certain criteria.

To mine Bitcoins, miners use computational power of specialized hardware known as ASICs (Application-Specific Integrated Circuits), computer's central processing unit (CPU) or graphics processing unit (GPU) to solve a mathematical puzzle by trying different combinations of a single value called “nonce” used to validate the information contained within a block.

More in depht, miners must find an input that includes a list of all of the most recent transactions and whose hash is below a certain limit, less than or equal to the numerical value of the “Target” hash. The mining program generates a random number, adds it to the current header hash, re-hashes the value, and compares it to the target hash. If the resulting hash value meets the requirements, the miner first add the block to the blockchain and is rewarded with a certain amount of the cryptocurrency. If the value does not match the target, the nonce is increased by one and the process starts over. This continues until a miner reaches the goal.

Since each hash created is random and impossible to predict, it can take millions of guesses – or hashes – before the goal is achieved and a miner gets the right to fill the next block and add it to the blockchain. Each time this happens, the successful miner is awarded a block reward of newly minted coins along with any commission payments associated with the transactions they store in the new block.

Generating these hash requires massive computational power and hence mining Bitcoin using the Proof-Of-Work mechanism is very costly and consumes large amounts of electricity.

Block Reward Halving

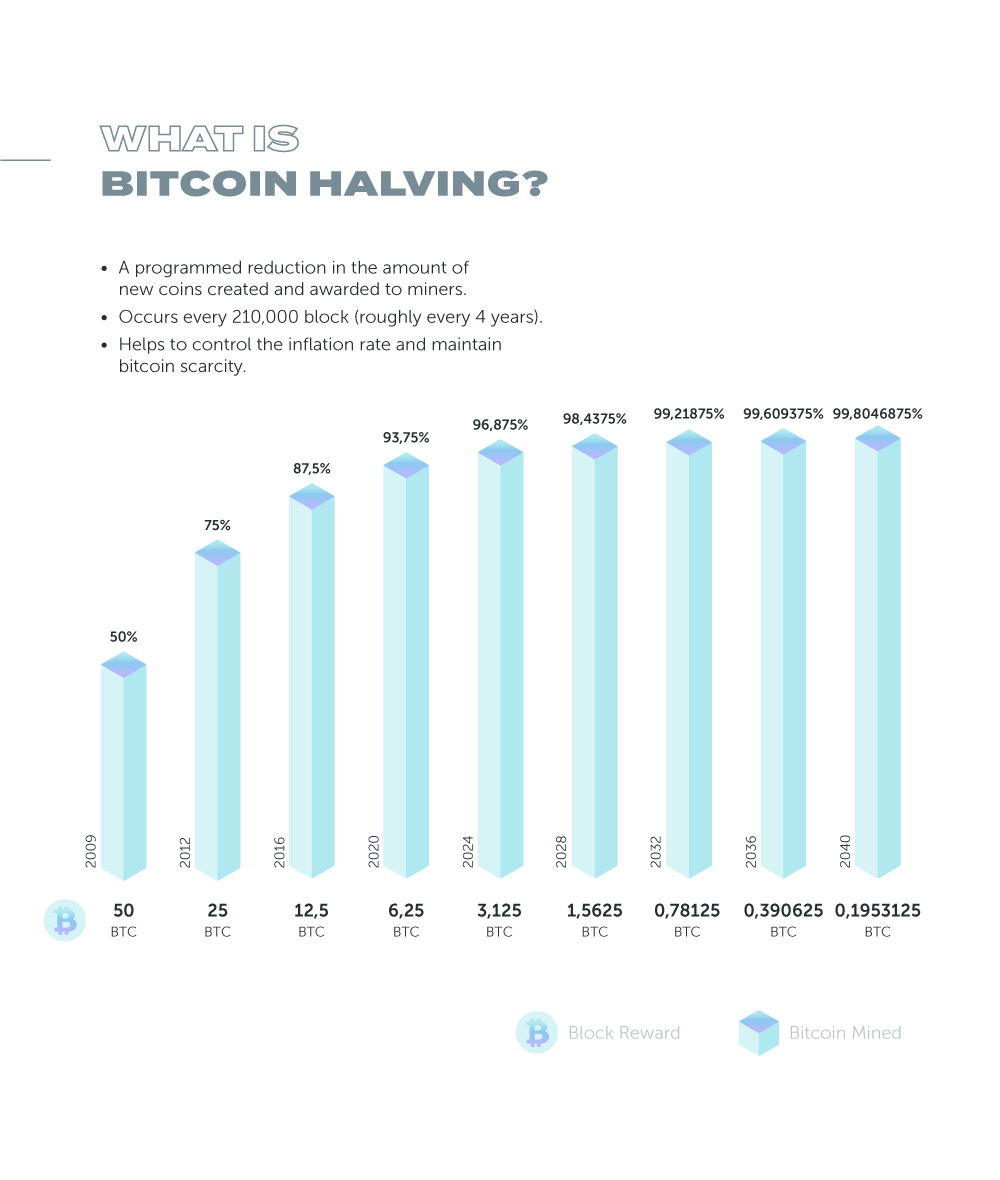

For most Proof-of-Work (PoW) blockchains, the block reward – a predetermined amount of free coins given to a miner who successfully mines a block on the blockchain – undergoes a scheduled halving in order to incrementally decrease the total supply over the mining lifespan of a coin. It is a way of incentivizing miners to participate in the network and secure the network through their computing power. The block reward is predetermined and decreases over time as specified by the protocol.

The halving of block rewards for Bitcoin occurs every 210,000 blocks, which is roughly every four years. This helps to control the inflation rate of the cryptocurrency and maintain its scarcity and with such changes comes the opportunity to profit. As of 2021, miners receive 6.25 bitcoins every time they mine a new block. The next Bitcoin halving is expected to occur in 2024 and will see BTC block rewards drop to 3,125 bitcoins per block.

Dash is another minable cryptocurrency that reduces its block rewards by 7.14% every 210,240 blocks, while Litecoin halves its rewards every 840,000 blocks.

What is the “Hash Rate” of Bitcoin

The Hash Rate – also known as hashing power – refers to the total combined computing power used to mine and process transactions on a Proof-of-Work blockchain, such as Bitcoin and Ethereum (before the 2.0 update). It refers to the number of hashes that a miner can perform in a given amount of time, typically measured in hashes per second (H/s). The higher the hash rate, the more secure the network is considered to be and the more difficult it is for an attacker to manipulate the network. It is also an important factor in determining the profitability of mining a particular cryptocurrency. Substantially, the hash rate is a measure of how many times the network can attempt to solve the mathematical problems necessary to validate transactions and produce new blocks.

Why hash rate is so important?

Hash rates matter in cryptocurrency for several reasons:

- Security -> The hash rate is a measure of the network's overall mining power, and a higher hash rate indicates that the network is more secure. This is because a higher hash rate makes it more difficult for an attacker to carry out a 51% attack, where they control more than half of the network's mining power and can manipulate the blockchain.

- Difficulty adjustment -> The hash rate also affects the difficulty of mining, which helps to regulate the rate at which new blocks are added to the blockchain. If the hash rate increases, the difficulty increases as well, making it harder to mine new blocks and slowing the rate at which new coins are produced.

- Block time -> The hash rate also affects the average time it takes to mine a block. A higher hash rate means that blocks are mined more quickly, reducing the time it takes for transactions to be confirmed and adding to the speed of the network.

- Network decentralization -> The distribution of hash rate among different miners helps to ensure the decentralization of the network. When the hash rate is highly centralized, it becomes more susceptible to manipulation and control by a single entity.

- Profitability -> The miner's or mining pool’s expected profit is directly proportional to the hash rate. A higher hash rate means more computational power, which increases the chances of finding a solution to the cryptographic puzzle and adding a block to the blockchain. As a result, the miner or mining pool is more likely to earn a reward for their efforts.

- Value -> A higher hash rate in the cryptocurrency network can have an indirect impact on the value of the cryptocurrency. The hash rate is a measure of the overall mining power of the network, and a higher hash rate – generally indicating increased security and stability – can also make investors more confident in the network and lead to higher demand for the cryptocurrency, which can drive up its price.

- Circulating Supply -> Additionally, the hash rate affects the rate at which new Bitcoins are mined and added to the circulating supply. When the hash rate is high, new Bitcoins are mined more quickly, increasing the supply and potentially putting downward pressure on the price. However, the overall impact of the hash rate on the price of Bitcoin is not straightforward and can also be influenced by other factors such as demand, regulatory changes, and global economic conditions.

In summary, hash rate is an important factor in the security, stability, and decentralization of a cryptocurrency network, but can also have both positive and negative impacts on the value of the cryptocurrency. A higher hash rate can indicate increased security and stability, which can positively affect the price, but it can also increase the supply of new coins and potentially put downward pressure on the price.

References

- Ray, S. (2021) Blockchain Security Mechanisms, Medium. Towards Data Science. Available here.

-

Engineer, E.S.P.S. and Engineer, M.M.A.S. (2019) What's the difference between encryption, hashing, encoding and obfuscation? Available here.

-

Kumar, D. (2021) Role of hash functions in cryptocurrencies, LinkedIn. Available here.

-

SoFi (2023) Bitcoin hash rate and why it matters, SoFi. SoFi. Available here.