Crypto Wallets and Exchanges: How Do They Work?

What are crypto wallets?

The main purpose of a cryptocurrency wallet is to safe-keep a person’s digital assets.

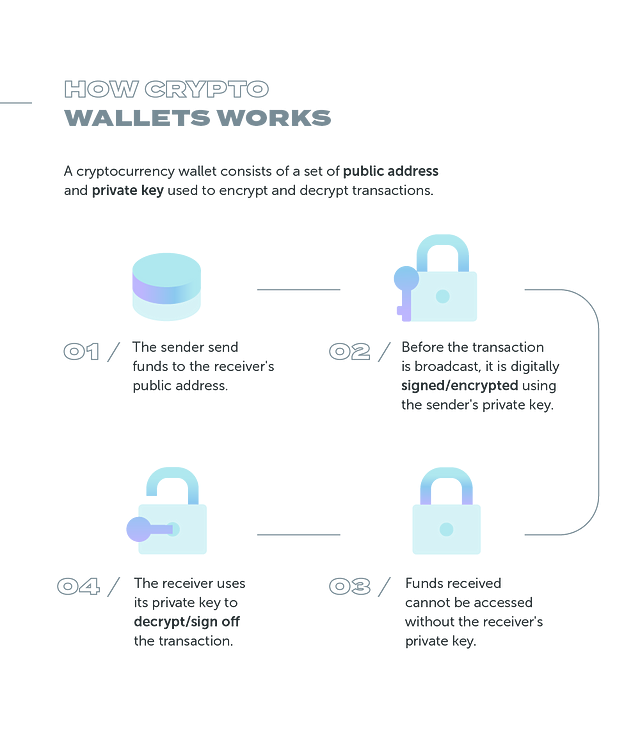

What is important to denote is that wallets do not actually store your crypto, as a normal wallet would with bank cards or cash. Instead, your holdings are decentrally stored on the publicly available blockchain - a system of recording information that allows for crypto transactions to occur - which wallets give access to.

They are able to do this by keeping your private keys (passwords that give you access to your cryptocurrency) safe and accessible - therefore wallets are vital for people to access their crypto in order to spend, send or receive them.

Crypto wallets essentially serve the purpose of securing cryptos and allowing access to tokens at any particular moment, as well as allowing for their long-term storage.

How do wallets work?

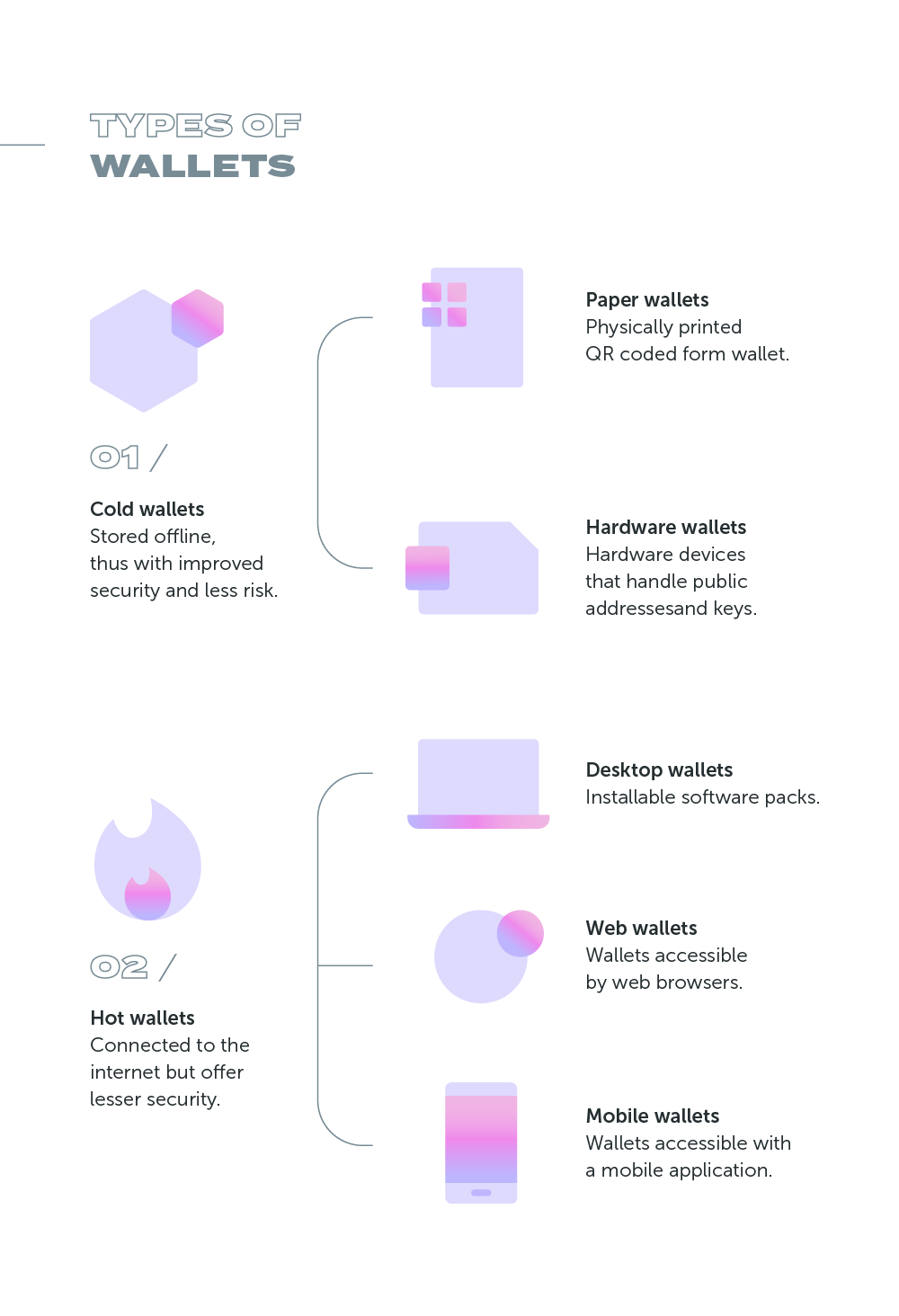

There are a range of crypto wallet solutions that users can choose from. These range from more secure and complex to less safe ones but make accessing your cryptocurrency slightly less difficult.

Essentially a wallet can be one of three things: a physical medium, a device or a program.

In the first instance, the key is written on a physical medium, like a piece of paper, and stored in a safe place. This makes using your crypto slightly more difficult, as it can only be accessed through the Internet.

If your key is stored in a device, it is more than likely stored in a drive device that is only connected to your computer when you want to use your crypto.

Lastly, and probably the most common storage tool are online wallets, that is to say keys that are stored in an app or any other software. This is popular among users because it makes accessing and sending your crypto as easy as using an online bank account.

What are crypto exchanges?

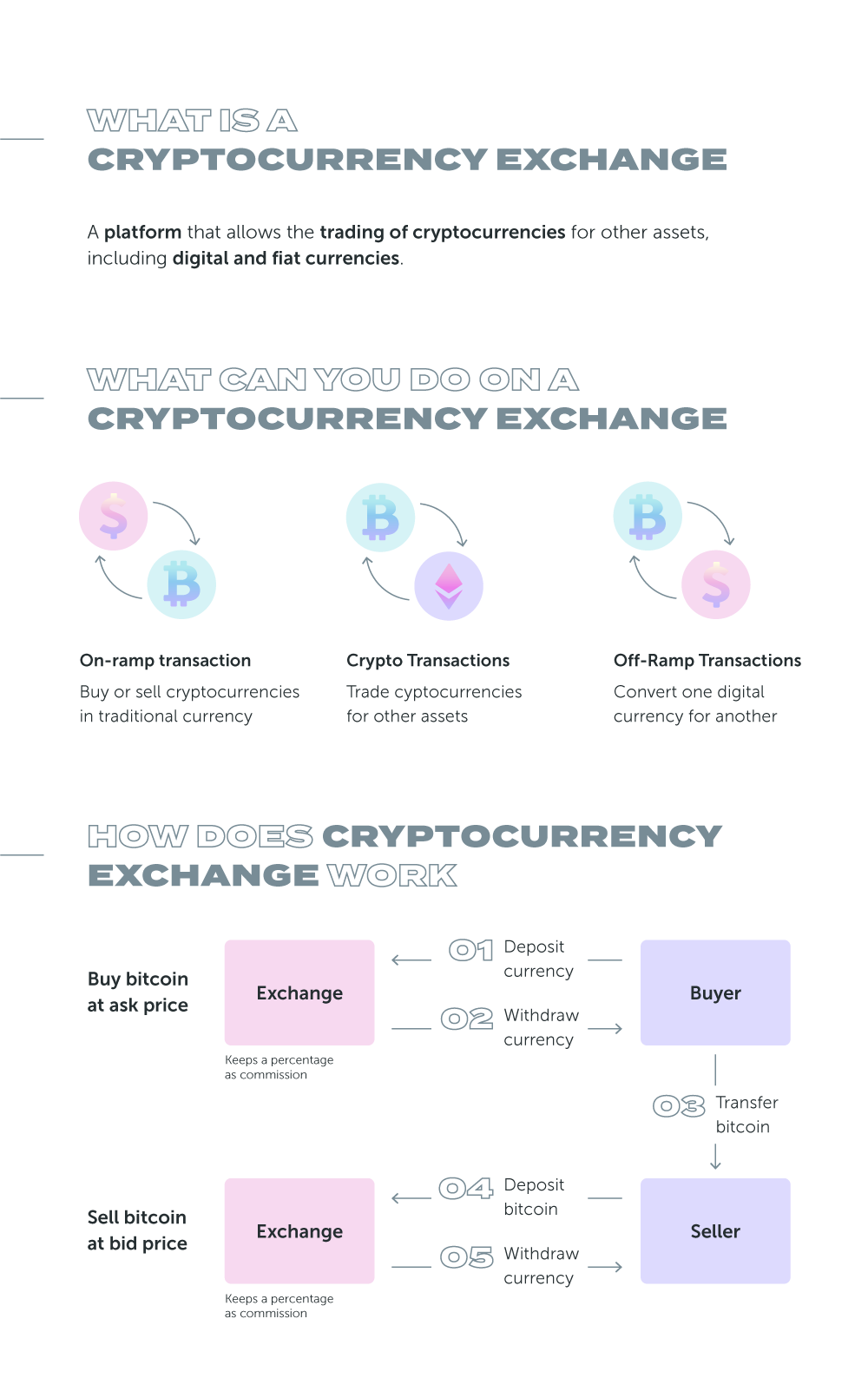

A cryptocurrency exchange is a platform that allows customers to buy and sell cryptocurrency.

Exchanges serve various functions: for example, a customer can trade one crypto for another, or simply buy crypto using fiat currency and/or stablecoins.

Exchanges may accept wire transfers, credit card payments or other forms of payment in exchange for digital currencies. They also typically allow customers to convert crypto back into selected fiat currencies, depending on the countries a given exchange has the license to operate.

Exchanges are often run by private businesses - the most popular ones include Binance, Coinbase and Kraken.

Differences between exchanges and wallets

The main difference between crypto wallets and exchanges is quite simple: while the wallet’s main purpose is to safe-keep your cryptocurrency, the exchange is there to facilitate the trading of assets. Therefore it would be convenient to initially store currency in exchanges, since it facilitates trading. But, ultimately, transfering funds to a wallet, where the trader has full control and security over their funds, is usually recommended, especially for large amounts.

In addition, some exchange platforms, such as eToro and Robinhood, allow users to purchase currency but not to withdraw it in a wallet. Other platforms, such as Binance, allow traders to do so.

Pros and cons of crypto wallets and exchanges

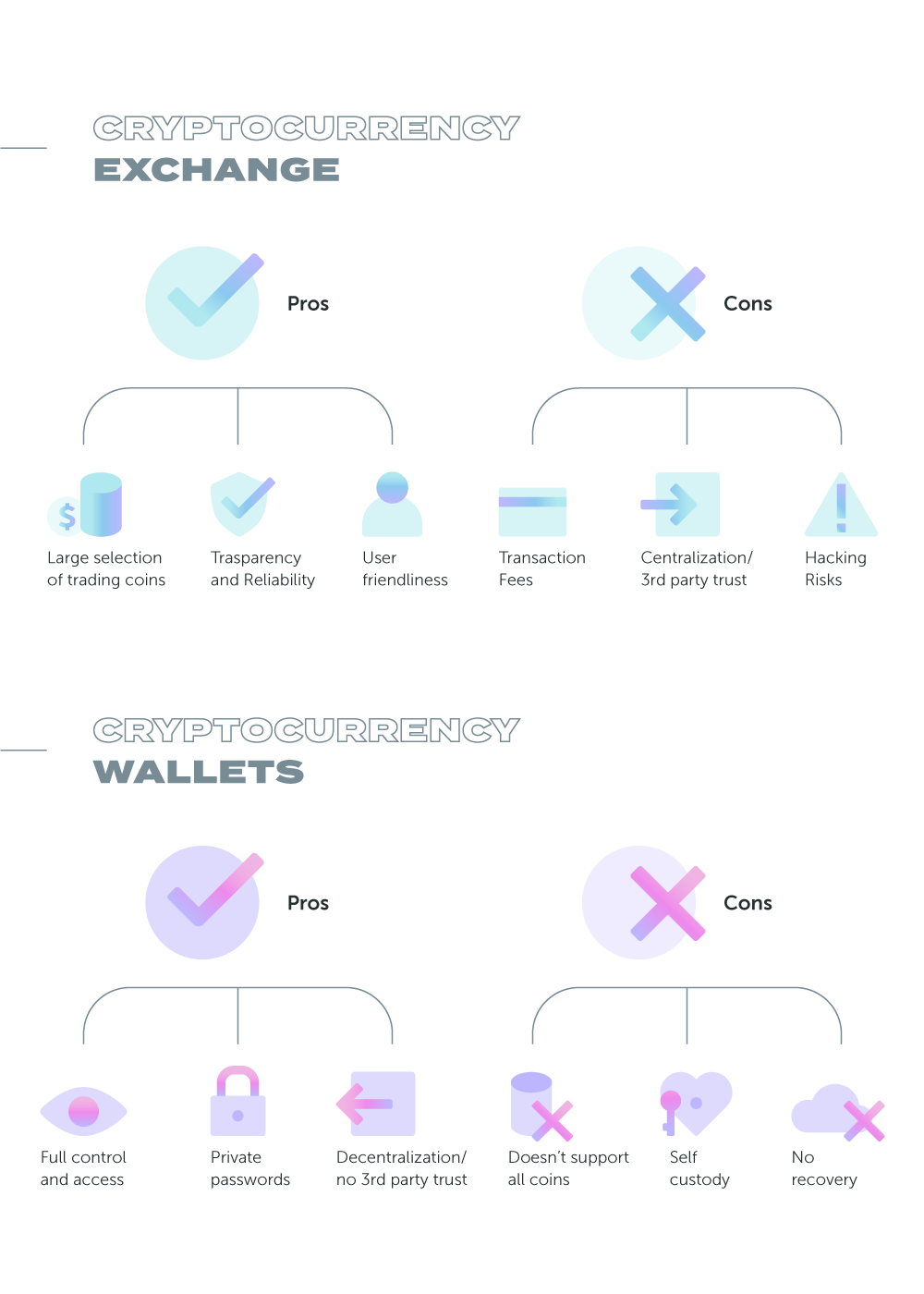

Crypto wallets have more pros than exchanges for the simple fact that they are ultimately more secure. Wallets give traders full control and access over their cryptocurrencies and their security, since keys are also involved.

However, if you are perhaps a frequent trader with experience in the field and perhaps like to take a few risks or execute more complex trades, exchanges may be the choice for you. However, you must always keep in mind that, ultimately, they will probably be less secure, as you have to trust the platforms to protect your key rather than do it yourself as a wallet would allow you to.

Conclusion

Recapping, cryptocurrencies can be accessed, sent and received through both digital wallets and exchanges.

Wallets safe-keep a person’s digital assets through keys, private passwords only the user knows, and that the user can decide where to store: in a physical medium (ex. piece of paper), a device (ex. hard drive) or a program (ex. app). Wallets do not actually store the trader’s crypto, but rather simply allow them to access blockchain, a decentralized system, where they are actually stored.

Exchanges are platforms that allow traders to buy and sell crypto. Users can trade cryptocurrencies for others, or buy crypto using fiat currencies and/or stablecoins. Exchanges facilitate the trading of assets, while wallets focus more on the safe-keeping of a trader’s crypto.

Exchanges and wallets are ultimately among the most vital components in the digital currency world, facilitating processes and giving users access to their currencies, as well as helping protect the trader’s crypto.