Key Components Of The Cryptocurrency Ecosystem

The Growth of Crypto Assets

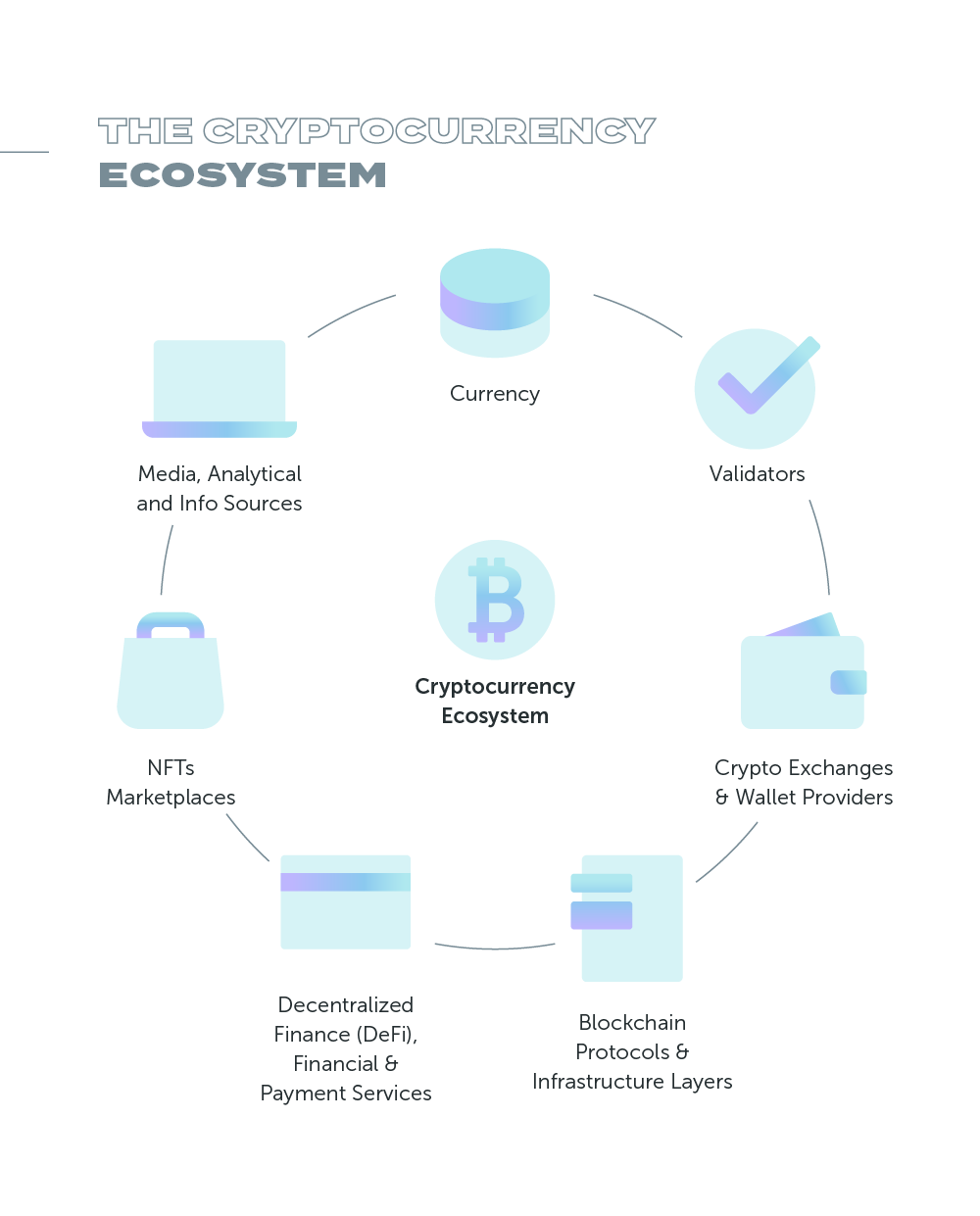

Cryptocurrencies are part of a broader ecosystem that extends well beyond the digital currencies, with unique solutions improving existing blockchain functionality emerging in finance, security, identification, social engagement, and ownership.

The crypto industry has grown exponentially since Bitcoin was created in 2009 and today it’s a massive industry comprised of crypto exchanges, blockchain protocols, financial services, data aggregators, technology providers, media, conferences, mobile apps, hardware tools, and a developing regulatory environment. As thousands of different protocols have been developed, many may have their own native cryptocurrency and blockchain-based applications, and thus a number of new economies emerge.

The blockchain – the underlying decentralized technology which cryptocurrencies are built on – has slowly evolved to more complex projects or programmable chains – known as decentralized apps, or dApps – which could be tailored for various use cases. This technology now powers a range of digital application and services that can be applied in virtually any industry in which assets are managed and transactions occur.

Categorizing the Crypto Ecosystem

The cryptocurrency economy is a a complex and constantly evolving ecosystem that comprises a unique range of products and solutions such as:

- Currency

Crypto assets that are transferable, primarily designed to be used as a unit of account, store of value, for speculation, payment purposes or as a medium of exchange. According to Coinmarketcap, there are more than 3,000 cryptocurrencies on the market by now. Prominent examples include:

- Coins, Altcoins and Tokens such as Bitcoin, Litecoin, Ethereum or XRP;

- Stablecoins such as Tether, Pax Dollar or DAI;

- Privacy Coins such as Monero, ZCash or Oasis Network.

- Validators (Miners and Stakers)

Crypto validators in a blockchain are responsible for verifying transactions, determine the accuracy of a transaction and add it to the distributed ledger. This way, the legitimacy of the blockchain and, subsequently, its transparent functioning remains intact. This category includes:

- Validators on Proof-of-Work (PoW) blockchains;

- Validators on Proof-of-Stake (PoS) blockchains.

Example of service providers for validators include Bitfury and Bitmain.

- Blockchain Protocols & Infrastructure Layers

The basic infrastructure that govern the transfer of data and maintain the security of the whole crypto network so that the digital money is exchanged securely. The rapid growth of blockchain in today's business world has given rise to hundred of different protocols, each being implemented across a wide range of ecosystem, technology stack and solutions. Some examples of different blockchain protocols include Ethereum, Hyperledger, Cardano, Ripple or Stellar, each with slightly different technological features, strengths and weaknesses.

- Crypto Exchanges & Wallet Providers

This category contains services designed for exchange cryptocurrencies into other cryptocurrencies, fiat currencies or viceversa and to provide users with custody, hold and access of crypto funds through their platforms, including:

- Wallets such as Trezor, Ledger or Exodus;

- Centralized and Decentralized Exchanges such as Coinbase, Binance or KyberNetwork.

- Decentralized Finance (DeFi), Financial & Payment Services

This cathegory gives access to a wide range of crypto-enabled financial, transaction & payment services – which uses smart contracts to support borrowing, lending and trading in crypto-assets – hosted on a shared infrastructures (or a decentralized blockchain) that allows financial transactions directly with others.

DeFi apps allow users to create stablecoins, lend money and earn interest, send and receive payments, take out a loan, trade, take positions on prediction markets, get into real estate and much more. Smart contracts are key to making decentralized services possible, as they execute pre-agreed activities automatically once certain conditions are met.

This category also includes token issuance and sales platforms that sell tokens to investors through fundraising activities – e.g., Initial Coin Offering, Initial Exchange Offering and Security Token Offering – and airdrop services that disseminate tokens freely to cryptocurrency users for advertisement purposes.

- Assets Tokenization such as Polymath or Tokeny;

- Airdrop Platforms such as AirDropAlert or AirDropBob;

- Prediction Markets such as Gnosis or Augur;

- Liquidity Platforms such as KeeperDAO or Bancor;

- Peer-to-peer (P2P) Lending such as BlockFi or Compound;

- Payment Networks such as Celer or Groundhog;

- Crypto Trading Bots such as eToro or Pionex;

- OTC desks such as Satstreet or CoinSmart;

- Crowdfunding Platforms such as Growdrop or PledgeCamp.

- NFTs Marketplaces

The most recent crypto trend has been in the non-fungible token (NFT) market, which is centred around the trading of digital artwork, music, videos and other online collectibles that have objective ownership through blockchain technology. OpenSea is the largest marketplace in the entire NFTs space by far. Other notable marketplaces include Rarible, SuperRare, Nifty Gateway, Foundation, and MakersPlace.

- Media, Analytical and Info Sources

Crypto media platforms have emerged in the crypto ecosystem as a reputable sources of information and insight that traders uses to learn about market trends, acquire real-time information and be aware of the latest tendencies. The most essential and useful information sources for traders and investors is CoinMarketcap along with the blockchain data platform Chainalysis or crypto trading tool TradingView. Other valuable sources include on-chain analysis tool DEXterlab and crypto data platforms DuneAnalytics and Glassnode.

References

- Visualizing the New Cryptocurrency Ecosystem, by Ashley Viens.

- Megatrends, Cryptocurrency Investing: Powerful Diversifier or Portfolio Kryptonite?

- ChainAnalysis, Key Players of the Cryptocurrency Ecosystem.

- Blockchain Ecosystem Explained In One Chart, by Harry Alford.

- Emerging blockchain-based applications and techniques, by Yinsheng Li.

- AAX Trends, Understanding The Crypto Ecosystem.

- Karim Sultan, Umar Ruhi, Rubina Lakhani, Conceptualizing Blockchains: Characteristics & Applications.

- Tokeny, Decentralized Finance (DeFi) Ecosystem.

- Cryptocurrency Trading Ecosystem, by Maxim Roslyakov.