The Risks and Returns of Cryptocurrency Investment

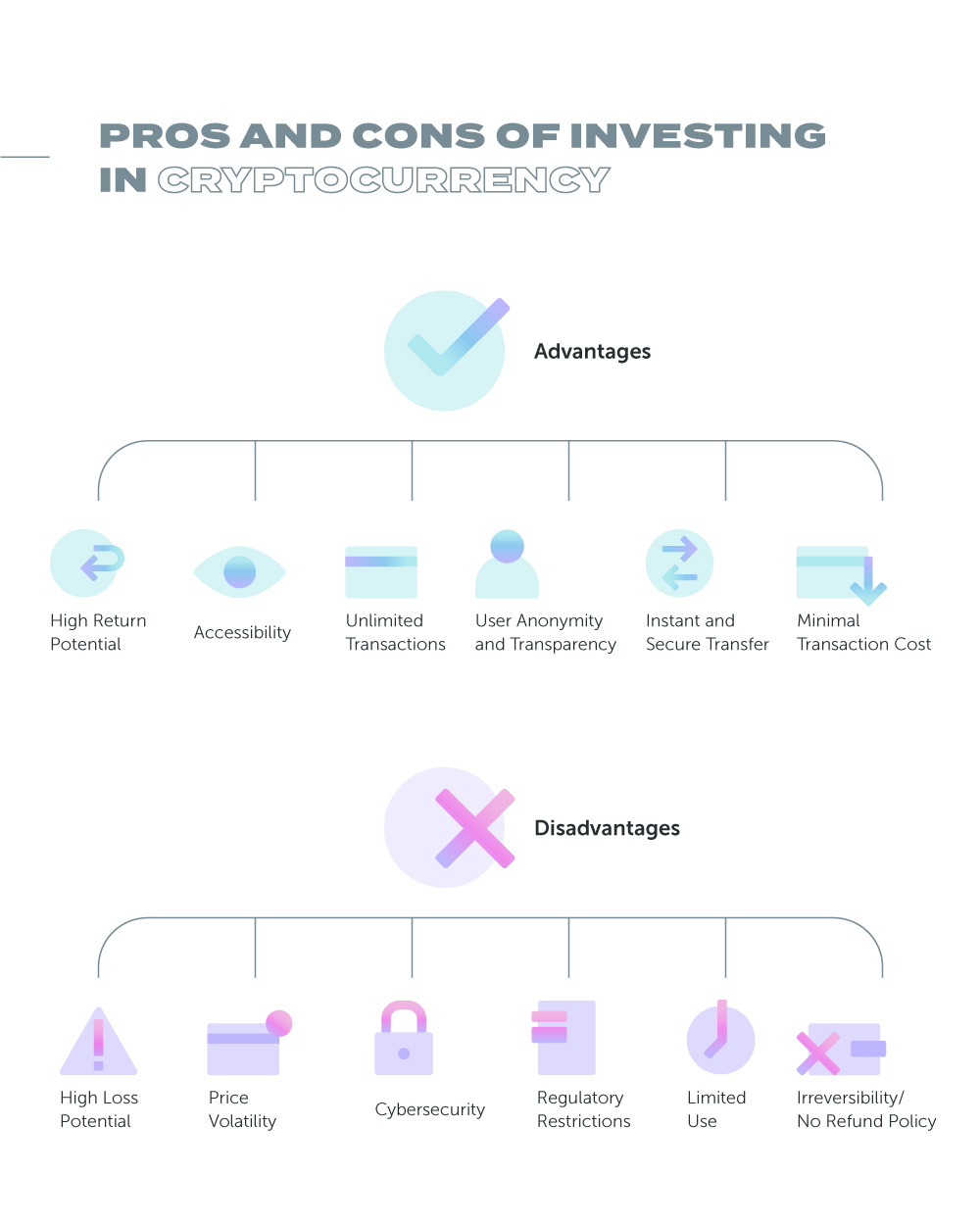

While cryptocurrency is today one of the most popular investment opportunities worldwide, it is important to understand the risks, as well as the rewards, associated with investing in digital currencies, before deciding to do so. Crypto, similarly to other investments, has great upsides, which however may come at an unexpected price: let’s see what they are.

The Cyber Risks Related to Cryptocurrency Investment

The most innate risk linked to crypto investments is the fact that they are vulnerable to hackers and cyberattacks, as are, by the way, other kinds of transactions. Such cases occur mostly when crypto is stored on exchanges, where they are more vulnerable to cyberattacks than stocks or bonds are. Exchanges facilitate the trading of coins but are not specifically there to protect the investments.

Another potential issue arises when a trader loses their private key, meaning they are unable to access their crypto. These security breaches can cause considerable losses to investors, so it is important to consider the cyber risks of crypto investing before choosing to do so.

Volatility and Regulations

Volatility is perhaps the biggest concern for novel investors. As Forbes magazine writes, “The price of Bitcoin - and all cryptocurrency for that matter - is incredibly volatile because it is such a young currency and market. It is not uncommon for the price of Bitcoin to experience wild swings within a day or even within minutes. This makes trading a dangerous venture.” It is therefore important to make informed decisions when investing, and even taking a look at prior highs a currency may have had, before choosing to invest.

The regulatory landscape of cryptocurrency investing is still very much a developing field. However, what we can determine is that crypto is an asset that is not backed by any institution or government, as a mainstream currency would be. It has value only because the people trading it say it does. An investor should also consider that regulations may be passed in the future that are against the crypto industry, potentially making coins lose value.

The Returns of Crypto Investing

These may vary from investor to investor, depending on how much crypto you will buy in how long a space of time. For example, as The Motley Fool states, “Owning some cryptocurrency can increase your portfolio’s diversification since crypto such as Bitcoin have historically shown no correlation with the US stock market. If you believe that crypto usage will become more widespread over time, then it probably makes sense for you to buy some crypto directly as part of your portfolio.”

If you were to invest in crypto, the coin with the highest return is Bitcoin, but again, there are always going to be certain risks involved with investing in crypto, even one that looks impenetrable on the outside.

A crypto trader will, at the end of the day, essentially have to be ready to accept both gains and losses. Your greatest gains will come as a result of seeking risks, which could also on the other hand spell losses. It is ultimately important to consider all of these aspects before deciding to invest, as well as not making hasty decisions that may spell financial ruin for an investor.